In the world of real estate, there are so many terms and phrases it can boggle the mind. 🤯 And agents tend to use a lot of “Realtor Speak” when communicating with clients.

We can’t help it. After so many years in the business, it’s just how we think and communicate with other professionals in the industry.

So forgive us for using our whacky terminology on you! To help out, below you will find many commonly used terms and real estate related definitions.

But if things aren’t clear or you still need answers to your questions, just reach out and we’ll be happy to help!

Welcome!

Welcome to our Frequently Asked Real Estate Questions page! Here you will find answers to some of the most common questions about buying and selling real estate.

Whether you are a first-time homebuyer or a seasoned investor, we have compiled a list of questions that can help you in your real estate journey.

Our goal is to provide you with the information you need to make informed decisions about your property.

If you have any additional questions, please don’t hesitate to contact us for more assistance. We look forward to helping you find the right property for your needs. Thank you for visiting!

Buying and Selling Real Estate

Are you looking to buy or sell a home?

If so, you may have a lot of questions about the real estate process. From finding the right property to understanding the paperwork involved, it can be overwhelming to navigate the real estate market.

To help make things easier, we’ve compiled a list of some of the most frequently asked real estate questions.

Whether you’re a first-time homebuyer or an experienced investor, these answers can help you get started on your real estate journey.

1. How do I find the right property for me?

The first step in finding the right property for you is to determine your budget and needs.

Consider the size of the home, location, and any special features you may want.

Once you have a better idea of what you’re looking for, start researching properties in your area.

You can search online, or contact a real estate agent for assistance.

2. What documents do I need to buy a home?

When buying a home, you’ll need to provide a few documents to your lender.

These include proof of income, bank statements, tax returns, and more.

Your lender will also require you to sign a purchase agreement, which outlines the terms of the sale.

Make sure to read through your purchase agreement carefully and ask questions if you don’t understand any of the language.

3. What is the process of selling a home?

Selling a home involves a few steps. First, you’ll need to list your property on the market and wait for offers.

Once you receive an offer, you’ll need to negotiate the terms with the buyer and sign a contract.

You’ll also need to complete the necessary paperwork and prepare the home for inspection.

After the inspection and appraisal are completed, you’ll need to close the sale and transfer the title.

4. What is the difference between renting and leasing?

The main difference between renting and leasing is the length of the agreement.

Renting typically requires a month-to-month agreement, while a lease is usually for a set period of time.

Renters are typically responsible for maintenance and repairs, while a landlord is usually responsible for these costs with a lease.

We hope this list of frequently asked real estate questions will be helpful as you navigate the real estate market.

If you have any additional questions, please contact a real estate professional for assistance.

Find the answers to your most asked questions about real estate. Click on the big + button to view the answer.

Financing

What is an Adjustable-rate mortgage (ARM)?

After an introductory period that could be 3, 5, 7, or 10 years, the interest rate on an adjustable-rate mortgage will be adjusted by the lender in accordance with current interest rates and your loan agreement.

For instance, a 5/1 ARM will have a fixed rate for the first five years, then the rate will vary based on a variety of factors. Your lender will explain the details before you accept the loan.

Typically, the interest rates on ARMs are lower for the fixed period which makes your payments more affordable during that period. However, the interest rate will generally go up along with your monthly payment after the rate is adjusted.

Homeowners consider ARMs riskier as you can’t predict what mortgage rates will be in the future.

What is Amortization?

The action or process of gradually writing off the initial cost of an asset.

Do you know what kind of mortgage you have? Do you know whether your payments are going to increase over time? 📈

“Amortization” is the term used for the schedule of mortgage installment payments over a period of time. Typically, a buyer’s amortization schedule is one payment per month over 15 or 30 years.

📢 Important:

📝 There are both adjustable and fixed-rate mortgages. With an adjustable rate, the lender can increase the rate on a predetermined schedule, which would impact your amortization schedule.

📝 With a fixed rate, your payments with remain the same for the life of the loan, unless you refinance or there are changes to taxes or insurance.

Leave a Reply

What is a bridge loan?

This short-term financing option can help you bridge the gap between buying a new home and selling your old one. It enables you to tap into your existing home equity before you’ve sold.

However, there are some issues to consider before you apply for a bridge loan:

👉 The interest rates and fees are usually higher than typical home loans.

👉 The equity from your current home will be used to secure the loan.

👉 The credit requirements are often greater for bridge loans than for standard financing.

If you think you may need to “bridge the gap” between buying a new home and selling your current one, give us a call. We can discuss your options and refer you to a lender who can help.

📲 925-628-2436

📩 info@guthriegrouphomes.com

Leave a Reply

What is a conforming loan?

A conforming loan is one that is limited to $647,200 for most of the U.S., which means you may be able to avoid the stricter requirements of a jumbo loan.

Loan limits vary over time and by location so you should check with your lender or Realtor for the latest information.

Other loan types include jumbo loans, FHA, and VA.

Leave a Reply

Conventional sale: When the property is owned outright and has no mortgage.

Conventional sales are often smoother transactions than those that require financing as there is no dependence on the buyer receiving a loan to purchase the property.

A conventional sale is not to be confused with a conventional loan. In this instance:

“Conventional” just means that the loan is not part of a specific government program. Conventional loans typically cost less than FHA loans but can be more difficult to get.

This may sound confusing, so just ask your Realtor to explain it to you if you’re not clear. ☺️

Leave a Reply

What is a credit score?

A number ranging from 300-850 that’s based on an analysis of your credit history.

Your credit score helps lenders determine the likelihood you’ll repay future debts.

You’ll need a score of 620 or better, but you’ll get better financing rates with a score of 720 or higher.

There is much more to know about credit and credit scores, so feel free to ask if you have specific questions.

To learn more about credit scores and credit reports, click here.

Leave a Reply

What is a Deed of Trust?

A Deed of Trust is like a mortgage. It is an agreement between a borrower (you) and a lender (a bank or other financial institution).

The lender gives you money to buy a house or other property, and you agree to repay the loan with interest, in regular payments.

The Deed of Trust also includes a clause that says if you don’t make the payments, the lender can take the property back.

Leave a Reply

What is a down payment?

The sum in cash that you can afford to pay at the time of purchase of a home or property.

A conventional loan down payment is usually 20% of the sales price, but other types of financing require as little as 3.5% to 15%. Some 0% down programs are also available.

A mortgage lender can tell you what types of loans you qualify for.

Leave a Reply

The equity in a home or property is the difference between how much your home is worth and how much you owe on your mortgage.

So if your home is worth $500,000 and you owe $450,000 on your mortgage, your equity in the home is $50,000.

See also home equity line of credit.

Leave a Reply

Escrow as it relates to real estate is a process of holding money and documents in a secure account while two parties complete a purchase.

Escrows are usually held by a Title and Escrow company.

This gives the buyer and seller peace of mind that the transaction is safe and that the buyer will not be able to take the money and run.

The escrow account ensures that the buyer has the necessary funds and that the seller will receive them when the transaction is complete.

See also close of escrow.

Leave a Reply

What is the FHA?

The FHA (Federal Housing Administration) is an agency of the US government that provides insurance for mortgages.

This insurance helps make it easier for people to get approved for a loan and makes it possible for them to get a loan with a smaller down payment.

The FHA also sets rules and standards for lenders to make sure that loans are fair and safe.

See also FHA Loan.

Leave a Reply

What is an FHA Loan?

A mortgage insured by the Federal Housing Administration – usually requires a good credit score and a down payment to qualify.

An FHA loan is a loan that is backed by the Federal Housing Administration. It is designed to help people buy a home who may not have the money to make a big down payment.

With an FHA loan, the borrower is able to make a smaller down payment and the government will help insure the loan, making it easier for the borrower to get approved.

Leave a Reply

What is a fixed-rate mortgage?

This mortgage’s interest rate will never change, even if the term of the loan is 30 years.

Fixed-rate mortgages typically have a term of 15 or 30 years.

Homeowners prefer this type of loan as it has a lower amount of risk compared to variable-rate loans, and the monthly payment remains the same for the life of the loan.

Leave a Reply

What is a Foreclosure?

When the lender takes ownership of a property due to failed payments by the buyer.

A foreclosure in real estate is when a homeowner stops making payments on their mortgage and the lender takes back the property.

The lender will then try to sell the property to recoup the money that was owed on the mortgage. Foreclosures can often be a lengthy and expensive process for the lender and the homeowner.

See also pre-foreclosure.

Leave a Reply

What is a HELOC?

A HELOC (Home Equity Line of Credit) is a type of loan that allows a homeowner to borrow against the equity in their home.

The borrower can use the money for whatever they choose and the interest rate is usually lower than other types of loans.

The loan is secured by the home, so if the borrower can’t make payments, the lender can take the house.

Sometimes a Home Equity Loan is a better choice for the borrower. Talk to your lender to find out more.

Leave a Reply

What is a Home Equity Loan?

A home equity loan — sometimes called a second mortgage — is a loan that’s secured by your home.

You get the loan for a specific amount of money and it must be repaid over a set period of time.

You typically repay the loan with equal monthly payments over a fixed term.

If you don’t repay the loan as agreed, your lender can foreclose on your home.

See also HELOC

Leave a Reply

What is a Jumbo Loan?

Conforming loan limits are $647,200 for most of the U.S., so anything above this would be a jumbo loan.

Jumbo loan requirements are stricter and there are more requirements you will need to satisfy.

Find out more about jumbo loans here.

Leave a Reply

What is a lender?

A lender, AKA Mortgage Lender is an entity that issues mortgage loans. Typically, a bank, mortgage broker, credit union, etc.

A mortgage lender is a bank or other financial institution that provides loans to people who want to buy a home.

The lender will look at a person’s credit history, income, and other factors to decide if they are eligible for a loan and how much they can borrow.

The lender will also discuss the different types of mortgages available and the interest rate and terms of the loan.

Leave a Reply

What is a Mortgage?

A mortgage is a loan from a lender or bank that is used to purchase your home. BTW, the “t” is silent, so it’s pronounced “more·guhj”.

A mortgage is a loan that a person takes out to buy a house.

The borrower pays the lender back over time with interest.

The mortgage is secured by the house, which means if the borrower can’t make payments, the lender can take the house.

Mortgages usually have a fixed interest rate and a set term (how long the loan will last).

For instance, a common mortgage is a 30-year fixed loan. That is, the loan lasts for 30 years and the interest rate remains the same over the life of the loan.

Leave a Reply

The interest rate on a mortgage loan you pay to borrow that money when buying a home.

The lower the rate, the better.

Mortgage rates vary daily, so you don’t have any particular rate until the lender “locks in the loan” securing that rate for your home purchase.

The rate you qualify for is based on your personal financial situation and the type of loan you are applying for.

Leave a Reply

What is a Pre-Approval Letter?

It is a letter from a lender indicating you qualify for a mortgage of a specific amount.

Getting Pre-Approved

You’ll fill out a mortgage application, provide documents, and bank statements, get a copy of your credit report, etc.

Getting pre-approved is what you need to do before starting a home search. The person selling your dream home will want to make sure you really are qualified to buy. Most sellers aren’t willing to accept your offer with only a pre-qualification.

Leave a Reply

What is getting Pre-Qualified?

You contact a lender, provide a bit of financial information to them, and they tell you about how much you can afford to buy. That’s about it. It’s usually done over the phone, and your credit report is not needed at this point.

WARNING!

You’ll want to get a Pre-Approval Letter from your lender before you start shopping for a home.

Leave a Reply

One of the first steps in purchasing a home is getting either pre-approved or pre-qualified for a mortgage. Unless of course, you’re buying with all cash. 😁

It’s very easy to get confused between the two things. So, should you get Pre-Qualified or Pre-Approved for a mortgage loan?

Without getting into too much detail, we’ll give you just the essentials to understanding the difference, not the complete procedure for each.

Pre-Qualified

This is the simpler of the 2 processes. You contact a lender, provide a bit of financial information to them, and they tell you about how much you can afford to buy. That’s about it. It’s usually done over the phone, and your credit report is not needed at this point.

WARNING! 🔥 It’s NOT a promise of a loan. You are not guaranteed any particular interest rate. And you are not ready to purchase a home. What you have is an idea of what you may be able to buy. It’s a starting point, and a good way to start planning.

Check out Investopedia for a more in-depth explanation if you’re curious. https://www.investopedia.com/articles/basics/07/prequalified-approved.asp

Pre-Approved

This one is where the rubber meets the road. Paperwork, and plenty of it. You’ll fill out a mortgage application, provide documents, bank statements, get a copy of your credit report, etc.

It takes more time and there are more questions. It’s best to start with plenty of time before you plan to start looking for a home. That way you can deal with finding the papers you thought were in that one file cabinet, get your updated investment info, and try to fix any credit issues you may have.

Getting pre-approved is what you need to do before starting a home search. The person selling your dream home will want to make sure you really are qualified to buy. Most sellers aren’t willing to accept your offer with only a pre-qualification.

Again find out more here. https://www.investopedia.com/articles/basics/07/prequalified-approved.asp

Conclusion

Save yourself some heartache, heartbreak, and hair-tearing-out. Get pre-approved before shopping for homes.

Better yet, call me, Libby Guthrie at 925-628-2436 and I’ll answer your questions about getting started, and if you like, I’ll connect you with the right lender for your situation.

Just so you know, before my 25 years as a real estate agent and broker, I spent 15 years in mortgage banking. I know what I’m talking about and I love to share my expertise with you and your family.

Contact me today, share this article with a friend, and please, share it on your favorite social site. Thanks!

Leave a Reply

What is a Reverse Mortgage?

A financial agreement in which a homeowner relinquishes equity in their home in exchange for regular payments, typically to supplement retirement income. This type of loan is for seniors ages 62 and older.

Should you get a reverse mortgage?

While it can be a great way to supplement your retirement income, there are some things to watch out for:

⚠️ High fees

To get and finalize your reverse mortgage, you’ll be paying a range of fees that can add up quickly.

⚠️ Variable or high-interest rate

The interest rate is often higher than that of a standard mortgage. It may also be variable, rather than fixed, which means it can increase in the future.

⚠️ Less money for your heirs

The remaining amount of your estate will need to be repaid when you’re no longer here, usually in a specific period of time, which can be costly and stressful for your family.

This is why, in some cases, downsizing can be a better option. If you’re deciding between the two, contact us to discuss your options and make the best choice for your needs.

Leave a Reply

What is a Settlement Statement?

A settlement statement, also known as a HUD-1, is a document that lists all the costs associated with buying or selling a home.

It includes the purchase price, loan fees, taxes, insurance, and any other costs that need to be paid at closing.

This document will be given to the buyer and seller at the closing of the real estate transaction.

Really good agents will also send you a copy of your HUD-1 right before tax time to make sure you take advantage of any tax-deductible expenses from the purchase or sale of your home.

Leave a Reply

What does it mean when you are Underwater?

The phrases “underwater” and “upside down” refer to a situation when the amount owed on a mortgage loan is greater than the value of the property.

In simpler terms, a house is underwater when the owner owes more on the mortgage than the house is worth.

You have various options on what to do if you are in this situation.

Leave a Reply

Here are 5 typical questions asked by homebuyers about getting their first mortgage loan.

How much do I need to save up for a down payment?

A conventional loan down payment is usually 20% of the sales price, but other types of financing require as little as 3.5% to 15%. A mortgage lender can tell you what types of loans you qualify for.

How do I know if I qualify for a loan and how much I can afford?

Contact a mortgage lender to get pre-approval for a loan. The lender will ask you some basic questions about your income and debts and can tell you what amount you can be approved for, and how much your mortgage payments will be. Ask me for my lender recommendations!

What does the lender need from me to give me a loan?

Usually, you are asked to provide your last two tax returns to show proof of income. You should also provide recent bank and credit card statements and proof of your current pay rate. You will also be asked for your social security number so they can run a credit check.

The lender may want to meet with you before asking for this documentation, or they may provide you with a list of which documents you need on your first appointment.

What’s the difference between pre-approved and pre-qualified?

While often used interchangeably, these terms don’t mean the same thing. Pre-qualification is an estimate of what you may be approved for based only on the verbal information you provide. Pre-approval means the lender has verified your income and debt information and run a credit check.

Also, read “Pre-Qualified vs Pre-Approved” for more details about the difference between pre-approved and pre-qualified.

How do I know which mortgage option is right for me?

Your mortgage lender is the best person to advise you on this question. Their products and qualifications change from time to time, so they would know best what products are available to meet your needs.

That said, you can always ask me, if you want a second opinion. I began my career in real estate as a mortgage lender.

Leave a Reply

Home Buyers

An Active Property

The property is actively for sale and on the market. The sellers may have received offers but have not accepted any yet.

When an offer is accepted the property will become Pending the completed sale.

If the contract falls through, typically the property will go Active again.

Leave a Reply

Active contingent in real estate is a status of a property listing indicating that it is under contract, but that the sale is contingent on certain conditions being met.

These conditions may include the sale of the buyer’s current home, the receipt of satisfactory inspection reports, or the approval of a loan.

If the conditions are not met, the listing may revert to active status.

Leave a Reply

What Does Active-Contingent Mean?

Along the same vein, we often get the question about the meaning of “active contingent” in real estate.

An active contingent offer is one of a variety of status updates given to a home listing. If a property has an active contingent label, it means the seller has accepted an offer from a buyer. But the home sale has certain contingencies that need to be met, and the seller is taking backup offers in case the first deal does not go through.

Similar to contingencies being protection for the buyer, having the listing be active contingent offers protections for the seller.

Having a home be active contingent can influence a buyer to release contingencies prematurely, or when they shouldn’t be, just so the “other guy” doesn’t get the house. This would be a mistake!

Buying and selling real estate can be a very emotional time. Relying on your agent to guide you through the process is the best way to end in a result that you will be happy with!

Leave a Reply

A professional analysis used to estimate the current value of the home in the real estate market.

This is a necessary step in validating a home’s worth to you and your lender as you secure financing.

All parties to the transaction hope the appraisal will come in at the same amount as the listing price.

If the appraisal comes in low, your options include backing out of the sale, having your agent appeal the low value, paying the difference in value in cash, and renegotiating the offer.

Leave a Reply

What does As-is mean?

A contract or offer clause stating that the seller will not repair or correct any problems with the property. Also used in listings and marketing materials.

In other words, selling a house as-is means that a buyer will get the property in its exact, current condition without any additional repairs or upgrades.

Leave a Reply

What does Back on Market mean?

The property was under contract with another buyer and their contract fell through, so it is Active again.

BOM stands for “back on the market” in real estate and is a common abbreviation used by real estate agents.

Leave a Reply

What is a backup offer?

When an offer is accepted contingent on the fall through or voiding of an accepted first offer.

Sellers may accept backup offers if they are not confident about the offer they have accepted.

Consider it a safety net for the seller if the current offer does not close.

There are also benefits for buyers.

Although it might seem like a long shot, putting an offer on a house that’s under contract actually has a reasonable chance of scoring you a home. Deals fall through for all kinds of reasons, so if you’re in the backup position, you’ll lock things in and keep a home from going back on the market.

As usual, discuss putting in a backup offer with your Realtor.

Leave a Reply

Once you have made your offer and the offer is accepted by the seller, the following questions may arise.

What does “under contract” mean?

Under contract means that all parties have agreed on terms, have signed the contract, and the signed contract has been delivered to both buyer and seller. Payment of the escrow deposit is expected but is not a requirement to make a binding contract.

What is escrow?

The escrow money, escrow deposit, or good faith deposit is money that is included with an offer, or as soon as an offer is accepted, to show the seller that you are serious about moving forward with the purchase of the home.

Because you forfeit this deposit if you back out of the purchase for any reason not allowed for in the contract, the larger the escrow deposit, the more seriously your offer is taken.

This is not the same as the down payment.

Do I need an inspection?

We always recommend that you have a home inspection done. In the grand scheme of things, paying a few hundred dollars to have peace of mind that there are no hidden dangers or problems is well worth the money.

The inspections you may need or want will vary depending on the home you are buying and the contract terms. Your agent will thoroughly discuss the inspections with you once your offer is accepted.

How much are inspections?

The cost of the home inspection depends on the size of the house and additional inspections requested, such as swimming pool, septic tank, termite/pets report, insurance, four-point (HVAC, plumbing, roof, and electrical,) wind mitigation, and radon. An average home inspection, without additional inspections, is about $300.

I will give you my recommendations for inspectors, but you can choose your own if you wish.

What if my loan doesn’t get approved?

If you have gone through the pre-approval process and have been forthcoming with all the information requested by your lender, it’s unlikely you will be turned down, but it does happen.

Make sure you do not change jobs, purchase big-ticket items on credit, take out a car or boat loan, or open any other new credit accounts while your mortgage is being processed.

If your loan does fall through, talk with your lender about changing to a different loan type.

When can I start moving?

When you have the keys! When you are financing your purchase, it takes four to six weeks for your loan to be processed. Once the lender gives the all-clear, closing is scheduled. You will sign your loan documents and both parties will sign documents transferring ownership to you.

Unless other arrangements have been agreed upon by both parties, the sellers should have completely vacated the home when they sign the closing papers. You can have your belongings ready to move, and a moving company scheduled before you go to closing.

At closing, you will receive the documentation you need to provide utility companies with proof of your new residence.

But seriously, everything is tentative until you have the keys! Even if the home is vacant, don’t even think of starting to move until escrow has closed and you have the thumbs up from your agent.

Leave a Reply

Buyer’s agent: The agent who shows the buyer’s property, negotiates the contract, or offer, and works with the buyer to close the transaction.

You might have heard of buyer’s agents, selling agents, listing agents, and so on. You’re a buyer, so what is a buyer’s agent? True to their name, buyer’s agents help real estate buyers navigate the real estate market; they can also save you tons of time and money on the road to your new home.

Read more to learn how a real estate buyer’s agent can help you.

Leave a Reply

Close of escrow is the final step in the real estate transaction. It is when the buyer pays the seller for the property and all the documents are signed.

After close of escrow, the title deed is transferred to the new owner and the keys are given to the buyer.

The escrow company then sends the money to the lender and all the parties involved in the transaction.

Leave a Reply

Closing: The end of a transaction where documents are signed, and funds are dispersed.

Leave a Reply

Closing costs are the fees that the buyer and seller will owe associated with the home-buying process, such as the real estate brokerage commission and title insurance.

Most are paid by the buyer, but the seller pays for some.

The fees will vary with each transaction. Your lender or title rep will let you know what the fees are and how much you will need at the close of escrow.

The fees required to complete the real estate transaction include points, taxes, title insurance, financing costs, and items that must be prepaid or paid through escrow.

Leave a Reply

Comparative market analysis or competitive market analysis, aka CMA, compares the sales price of similar properties in the area to help determine the price of a property.

A CMA estimates a home’s price based on recently sold, similar properties in the immediate area. Real estate agents and brokers create CMA reports to help sellers set listing prices for their homes and help buyers make competitive offers.

If you need more details about CMAs, read “What Is Comparative Market Analysis (CMA) in Real Estate?“.

Not to be confused with Country Music Awards. 🤓

Leave a Reply

A condominium (Condo) is a type of housing where several people own separate units in a larger building or complex.

Each unit is owned by an individual and the common areas, such as the lobby, pool, and gym, are shared by everyone who lives in the building.

Condominiums are often popular because they are often located in desirable areas and offer amenities that single–family homes don‘t.

What is the difference between a condo and a townhouse?

A condo is a type of housing where several people own separate units in a larger building or complex. Each unit is owned by an individual and the common areas, such as the lobby, pool, and gym, are shared by everyone who lives in the building.

A townhouse is similar to a condo, but it is usually smaller and more like a single–family home. Townhouses may have more amenities like a private backyard or a garage.

Leave a Reply

What is a conforming loan?

A conforming loan is one that is limited to $647,200 for most of the U.S., which means you may be able to avoid the stricter requirements of a jumbo loan.

Loan limits vary over time and by location so you should check with your lender or Realtor for the latest information.

Other loan types include jumbo loans, FHA, and VA.

Leave a Reply

What is a Contingency?

A provision of the contract that keeps the agreement from being fully legally binding until a certain condition(s) is met.

For example, the purchase of a home can be contingent upon the buyer selling their home first.

Every real estate contract includes space for “contingency clauses,” or conditions put forth by the homebuyer and home seller that must be met for the transaction to close.

Here are some types of contingency clauses you might see in your next home sale…

📝 Home Inspection / Due Diligence

📝 Cost-of-Repair

📝 Appraisal

📝 Financing or Mortgage

📝 Sale and Settlement

Contingency clauses can be tricky to navigate, which is why it’s always a good idea to have a licensed real estate professional guide you through the process.

We know this lingo inside and out, so reach out if you’re thinking about buying or selling a home soon!

Leave a Reply

In real estate, a contingent offer is an offer made on a property, which says that certain conditions must be met in order for the sale to be completed.

Leave a Reply

A real estate contract is a legally binding agreement between two parties for the sale and purchase of a property.

It outlines the price, terms, and conditions of the sale. It also includes any other agreements that the buyer and seller have made, such as repairs that need to be done before the sale is completed.

All real estate contracts must be written and signed by both parties.

Leave a Reply

A counteroffer is a response to a buyer’s original offer on a house to make changes that better fit a seller’s goals.

A counteroffer is one step closer to an accepted offer!

A counteroffer shows that the seller is willing to work with the buyer, but on slightly different terms (usually a change in the price or contingencies).

Here’s how your real estate agent can help you navigate a counteroffer:

☑️ Buyers, we negotiate on your behalf and provide guidance on how to get your offer accepted.

☑️ Sellers, we help you stay clear of red flags and make sure you accept the right offer.

Negotiation is a BIG part of what we do as real estate pros! Connect with our team to learn more about how we provide 5-star representation for our clients.

Leave a Reply

What is a credit score?

A number ranging from 300-850 that’s based on an analysis of your credit history.

Your credit score helps lenders determine the likelihood you’ll repay future debts.

You’ll need a score of 620 or better, but you’ll get better financing rates with a score of 720 or higher.

There is much more to know about credit and credit scores, so feel free to ask if you have specific questions.

To learn more about credit scores and credit reports, click here.

Leave a Reply

Days on market (DOM) means the number of days a home has been listed on the market.

The number of days the property has been on the market may reflect the desirability and/or pricing of the home.

If the home has been on the market too long, the property may be stale.

Leave a Reply

In real estate, what is a deed?

A deed is a document that shows who owns a piece of property. When someone buys a house, they get a deed that shows they are the owners. The deed has the names of the people who bought the house and is signed and notarized so it is legally valid.

This is not to be confused with a deed of trust. A deed conveys ownership; a deed of trust secures a loan.

Leave a Reply

What is a Deed of Trust?

A Deed of Trust is like a mortgage. It is an agreement between a borrower (you) and a lender (a bank or other financial institution).

The lender gives you money to buy a house or other property, and you agree to repay the loan with interest, in regular payments.

The Deed of Trust also includes a clause that says if you don’t make the payments, the lender can take the property back.

Leave a Reply

What is a Disclosure Statement 🤔

Also known as a “Seller’s Disclosure,” this is a legal document that outlines any known flaws that a home seller is aware of that could negatively impact the home’s value 🏡

💡 TIP: Buyers should scrutinize this document closely with their real estate agent to fully understand the condition of a home.

Our best advice? When it comes to buying a home, make sure you get an inspection to confirm what has been disclosed is accurate and discuss any potential deal breakers with your agent.

Contact our team for a ✨ free consultation ✨ to learn more about what you must legally disclose if selling and how to ensure you don’t miss any important information if you’re buying!

Leave a Reply

What is a down payment?

The sum in cash that you can afford to pay at the time of purchase of a home or property.

A conventional loan down payment is usually 20% of the sales price, but other types of financing require as little as 3.5% to 15%. Some 0% down programs are also available.

A mortgage lender can tell you what types of loans you qualify for.

Leave a Reply

The representation of opposing principals (buyers & sellers) at the same time.

That is, one real estate agent represents both the buyer and the seller in one transaction (sale of a home).

Leave a Reply

What is Due Diligence?

How to prevent #buyersremorse 👇

When buying a home, it’s extremely important to do your “due diligence.” During this period, you’ll look into the condition of your chosen property and compare it to other homes like it to make sure it’s really a good fit and value.

When a homebuyer investigates facts about the physical and financial condition of the property and its area before they make an offer and after their contract is accepted.

Due diligence is reasonable steps taken by a person in order to satisfy a legal requirement, especially in buying or selling real estate.

As your agent, we’ll guide you through this process by pointing out and addressing any of the home’s red flags so you feel completely confident about your purchase.

Leave a Reply

What is Earnest Money? 🤔

A deposit made to a seller that represents a buyer’s good faith to buy a home. It’s typically around 1% – 5% of the sale price.

Earnest money is a deposit from the buyer to the seller, made in good faith to show dedication to purchasing the property 🏡

IMPORTANT FACTS 👇

💰 The amount varies by market

💰 Goes towards the purchase of your home

💰 Protects the seller if a buyer backs out

💰 A buyer may get this money back – due to failed inspections or contingencies

💡 TIP: In a seller’s market, you may consider making your earnest money non-refundable.

Our best advice? When it comes to buying in a low inventory, competitive market, it’s essential to partner with a Buyer’s Agent who understands how to make your offer stand out to sellers 🥊

Leave a Reply

What is an easement? 🔎🏡

A right to cross or otherwise use someone else’s land for a specified purpose.

The term often crops up after buyers have made an offer on a home that’s been accepted, at which point a title search brings up the easement—which is essentially the legal right for someone else to use the property, or part of the property for a specific purpose.

Say what? You bend over backward to buy a home and now you have to share?! Don’t worry, in most cases, it’s not as bad as it sounds.

Types of Easements:

📝 Right of way: This is where a neighbor may need to pass through the property via a driveway to access the main road, a neighborhood playground, or a community feature (like a lake).

📝 Utility maintenance: This easement is typically granted to utility companies to run power and cable lines on a property.

📝 HOAs/condos: If you live in a condo or home managed by a homeowners association, odds are these institutions own much of the property—while residents have rights to pass through.

Leave a Reply

What is an escalation clause?

An escalation clause is a clause in a real estate contract that allows the purchase price of a property to increase if a certain condition is met.

For example, if the buyer and seller agree to an escalation clause and the market value of the property increases, the buyer will have to pay more for the property than originally agreed upon.

This clause is typically used when two buyers are competing to purchase the same property.

Leave a Reply

What is an expired listing?

A real estate listing that has expired and is no longer active, usually because it didn’t sell in the amount of time agreed upon by the listing agent and the owner of the home.

Other reasons for a listing to expire are the asking price was not met, or there were other issues with the property.

If you see an Expired listing, the owner may still be interested in selling. Ask your agent about it.

Leave a Reply

What is a final walkthrough?

The last inspection of the property before signing the closing documents.

A final walkthrough in real estate is when a buyer goes through the property one last time before the closing.

The buyer makes sure that all the items in the contract are in the same condition they were in when the buyer agreed to purchase the property.

This includes checking for any damage, making sure all appliances are working, and ensuring that all repairs agreed upon by the seller have been done.

Leave a Reply

What is a FSBO?

FSBO stands for “For Sale by Owner”. Often pronounced “fizbo”.

The owner of the home has it listed without an agent representation.

The buyer’s agent can usually still show the home, as many FSBOs will agree to work with agents representing a buyer.

Be wary of FSBOs since rarely does the homeowner have the requisite knowledge, experience, and understanding needed to sell a property.

Leave a Reply

A home inspector examines your home for integrity – such as the HVAC system, electrical, plumbing, attic, flooring, foundation, etc.

Leave a Reply

What is a Homeowners Association (HOA)?

A private organization that is often formed by a real estate developer to manage homes and lots in a residential subdivision.

A Homeowners Association (HOA) is an organization made up of homeowners who live in a specific neighborhood or development.

The HOA is responsible for managing and maintaining the common areas of the neighborhood, such as parks and playgrounds.

They may also have rules in place that all homeowners must follow, such as restrictions on landscaping or noise levels.

Leave a Reply

If you know where you want to live, have a steady and secure income, and are ready for the responsibilities of homeownership, then it might be time to invest in a home.

Read “5 Questions to Ask Before Purchasing Your First Home” to learn more about determining if now is the right time to buy for you.

Leave a Reply

What are real estate inspections?

Real estate inspections are when a professional inspector looks at a property to make sure it is in good condition.

They will look for any potential problems that could affect the safety or value of the property.

They will also check things like the roof, plumbing, and electrical systems to make sure they are in good working order.

An inspection can help protect buyers from buying a property with hidden problems.

There are a number of inspection types including home inspection, pest inspection, roof inspection, and more.

Your Realtor will help you decide which inspections are appropriate for your situation.

Leave a Reply

What is a Jumbo Loan?

Conforming loan limits are $647,200 for most of the U.S., so anything above this would be a jumbo loan.

Jumbo loan requirements are stricter and there are more requirements you will need to satisfy.

Find out more about jumbo loans here.

Leave a Reply

What is a Listing?

In real estate, the word “listing” is typically used to refer to the for-sale home or property itself, although it technically means the agreement between the broker and the owner of the home to market and sell the property.

This is not the same as listing the property on the MLS (Multiple Listing Service).

Leave a Reply

Mello-Roos Taxes – Definition

What is or are Mello-Roos? Sometimes misspelled “melarose”, these are special assessment taxes for Community Facilities Districts or CFDs. Typically new communities need additional infrastructures such as police and fire protection services, ambulance and paramedic services, parks, elementary and secondary schools, libraries, museums, and cultural facilities.

These taxes are liens which are usually municipal bonds issued to fund this needed infrastructure before a housing development is built. These are in addition to your regular property taxes. When buying your new home, any unpaid special assessments are paid by the seller.

The buyer (that’s you) will take title of the home subject to the condition that these special assessments will continue to occur in the future. That means you will be paying Mello-Roos taxes for as long as you own the home, or until they expire. The bonds issued for Mello-Roos may expire in 10 to 40 years, depending on the CFD.

There are four Community Facilities Districts in Brentwood for instance, along with various other communities in California.

To find out if the home you are looking to buy is in a Mello-Roos district, you have to know the parcel number of the property.

We can do that for you!

Also, the seller must disclose that the property has Mello-Roos taxes before you actually purchase, so you will know in advance either way.

Mello-Roos Tax – Conclusion

Let’s sum this up. Some homes in CFDs have special tax assessments called Mello-Roos. These communities benefit from having additional infrastructures such as new schools, libraries, and other community enhancements. Homebuyers in these districts will have to pay these taxes along with regular property taxes for as long as they own the home, or until the additional tax expires.

You, along with your Real Estate Agent can determine if buying a home with Mellow-Roos is right for you.

Leave a Reply

What is the MLS?

MLS stands for Multiple Listing Service. They collect, compile and distribute all information about homes listed for sale.

The MLS is the organization real estate brokers use to search for and list properties for their clients.

Membership isn’t open to the general public, although selected MLS data may be sold to real estate listing websites, like Realtor.com or our own MLS listing search where the public can search the MLS at no charge.

See also the term “listing“.

Leave a Reply

The interest rate on a mortgage loan you pay to borrow that money when buying a home.

The lower the rate, the better.

Mortgage rates vary daily, so you don’t have any particular rate until the lender “locks in the loan” securing that rate for your home purchase.

The rate you qualify for is based on your personal financial situation and the type of loan you are applying for.

Leave a Reply

What are Natural Hazards Disclosure Reports?

Natural hazards disclosure reports are reports that tell potential buyers about any natural hazards near a property.

These hazards can include things like flooding, earthquakes, and wildfires.

The report will also include information about potential risks associated with these hazards and what the buyer can do to protect their property.

The report is usually provided by the seller before the sale is finalized.

Leave a Reply

What is an offer to purchase?

Typically just an “offer”, is when a buyer proposes certain terms and presents these terms to the seller.

When you make an offer on a house, you and your agent will discuss the terms of your offer and submit the offer to the home seller’s agent.

Your offer may be accepted, or rejected, or the seller may submit a counteroffer.

Leave a Reply

What does Pending mean?

With a property that is pending, the property owner has accepted an offer from a buyer and they are under contract with that buyer.

Their agreement may be subject to a variety of contingencies: inspections, appraisal, financing, and more.

The home is not sold just yet. Typically if the sale does not go through, the house will return to “Active” status.

Leave a Reply

What is a Pre-Approval Letter?

It is a letter from a lender indicating you qualify for a mortgage of a specific amount.

Getting Pre-Approved

You’ll fill out a mortgage application, provide documents, and bank statements, get a copy of your credit report, etc.

Getting pre-approved is what you need to do before starting a home search. The person selling your dream home will want to make sure you really are qualified to buy. Most sellers aren’t willing to accept your offer with only a pre-qualification.

Leave a Reply

What is getting Pre-Qualified?

You contact a lender, provide a bit of financial information to them, and they tell you about how much you can afford to buy. That’s about it. It’s usually done over the phone, and your credit report is not needed at this point.

WARNING!

You’ll want to get a Pre-Approval Letter from your lender before you start shopping for a home.

Leave a Reply

One of the first steps in purchasing a home is getting either pre-approved or pre-qualified for a mortgage. Unless of course, you’re buying with all cash. 😁

It’s very easy to get confused between the two things. So, should you get Pre-Qualified or Pre-Approved for a mortgage loan?

Without getting into too much detail, we’ll give you just the essentials to understanding the difference, not the complete procedure for each.

Pre-Qualified

This is the simpler of the 2 processes. You contact a lender, provide a bit of financial information to them, and they tell you about how much you can afford to buy. That’s about it. It’s usually done over the phone, and your credit report is not needed at this point.

WARNING! 🔥 It’s NOT a promise of a loan. You are not guaranteed any particular interest rate. And you are not ready to purchase a home. What you have is an idea of what you may be able to buy. It’s a starting point, and a good way to start planning.

Check out Investopedia for a more in-depth explanation if you’re curious. https://www.investopedia.com/articles/basics/07/prequalified-approved.asp

Pre-Approved

This one is where the rubber meets the road. Paperwork, and plenty of it. You’ll fill out a mortgage application, provide documents, bank statements, get a copy of your credit report, etc.

It takes more time and there are more questions. It’s best to start with plenty of time before you plan to start looking for a home. That way you can deal with finding the papers you thought were in that one file cabinet, get your updated investment info, and try to fix any credit issues you may have.

Getting pre-approved is what you need to do before starting a home search. The person selling your dream home will want to make sure you really are qualified to buy. Most sellers aren’t willing to accept your offer with only a pre-qualification.

Again find out more here. https://www.investopedia.com/articles/basics/07/prequalified-approved.asp

Conclusion

Save yourself some heartache, heartbreak, and hair-tearing-out. Get pre-approved before shopping for homes.

Better yet, call me, Libby Guthrie at 925-628-2436 and I’ll answer your questions about getting started, and if you like, I’ll connect you with the right lender for your situation.

Just so you know, before my 25 years as a real estate agent and broker, I spent 15 years in mortgage banking. I know what I’m talking about and I love to share my expertise with you and your family.

Contact me today, share this article with a friend, and please, share it on your favorite social site. Thanks!

Leave a Reply

What are Property Taxes?

A levy or tax imposed by a municipality on real estate and personal property. The amount of tax varies depending on the property value.

Property taxes are an annual tax that local municipalities collect each year, based on the assessed value of your property (not on the appraised value of your home). These funds help pay for services that benefit the community, such as schools, roads, maintenance, etc.

First-time homeowners often forget to factor property taxes into the overall cost of their new home, which can come as a nasty shock come tax season. So let this be a reminder to all homeowners to calculate property taxes into their annual budget!

Leave a Reply

What is a Purchase and Sale Agreement?

Often just a “purchase agreement”, it is the written contract between the buyer and seller that outlines the terms of the sale.

The completion and signing of a purchase agreement effectively places both the buyer and seller (as well as the property in question) “under contract.”

Does a real estate purchase agreement need to be notarized?

No, a real estate purchase agreement does not require notarization to be valid as it is not filed with county records.

Leave a Reply

Buying a home is one of the most important purchases you’ll ever make. We’re here to help you understand the home-buying process so you know what to expect. Today, we’re talking about what you need to do before you even begin.

What can I afford?

Figuring out what you can afford will determine the course of your home-buying process. This all depends on a few different factors including how much you make a year, how much you pay towards your debt every month, and how much of a down payment you expect to make.

Other things to consider are your debt-to-income ratio, property tax, loan term and interest rate, home insurance, and possibly monthly Home Owners Association (HOA) dues. All of this can add up!

Zillow has a good home affordability calculator that can get you started.

What do I want?

Make a list of your wants and work from there. Maybe you have young children and want a friendly neighborhood with kids that play on the street. Perhaps you are older and enjoying retirement and want to walk out to the golf course.

Ask yourself what’s important to you and the way you live and work. Do you want good schools? Nice parks? Lots of shopping with great restaurants? Questions like these will help you narrow down what you’re looking for.

How’s my credit?

Unless you’re going to be buying your home for cash, you are going to need to finance it. It’s important to pick the right lender, but even before all that, you need to review your credit situation. After all, your lender will look at your credit and so should you!

You can start the process on your own by getting a copy of your credit report. There are a lot of different ways to do this. Credit Karma is a popular free website that gives you an updated credit report every month. This is a great way to keep track of precisely what is going on with your credit.

Once you have the credit report, take a good look at it. Make sure that everything is correct and up to date. If you notice anything wrong, work to correct those immediately. If your credit isn’t great, there are ways to improve it.

Remember: the better your credit, the better your mortgage rates will be. A reasonable mortgage rate can save you a lot of money in the long run.

Need more help? Give me a call! I’m an expert on credit and mortgage information and may be able to help you better understand your situation.

Leave a Reply

What is a Real Estate Agent?

A licensed professional that represents a buyer or seller.

A real estate agent is a professional who helps people buy or sell property.

They will help you find a home that meets your needs, negotiate a purchase price, and handle all the paperwork that comes with buying or selling a house.

A real estate agent can also answer questions about the local housing market and provide advice on things like taxes and financing.

The agent may or may not be a Realtor®.

Leave a Reply

What is a real estate broker?

A real estate broker is a licensed professional that represents a buyer or seller – they can own and operate a brokerage with subordinate agents.

A real estate broker is a licensed professional who helps people buy or sell property.

They are more experienced than real estate agents and typically have additional training, including a broker’s license.

Brokers can help you find a home that meets your needs, negotiate a purchase price, and handle all the paperwork that comes with buying or selling a house.

They can also answer questions about the local housing market and provide advice on things like taxes and financing.

Real Estate agents work under the Broker of record for a real estate office.

Leave a Reply

An individual who provides services in buying and selling homes.

Real estate professionals are there to help you through the confusing paperwork, find your dream home, negotiate any of the details that come up, and so you know exactly what’s going on in the housing market.

There are several types of real estate professionals including Realtors®, real estate agents, and real estate consultants.

Leave a Reply

What is a REALTOR®?

A designation that the agent is a member of the National Association of REALTORS®.

A Realtor is a real estate professional who is a member of the National Association of Realtors (NAR).

Realtors must have a license and have met certain standards for education and experience.

They help people buy or sell property, including finding a home that meets their needs, negotiating a purchase price, and handling all the paperwork that comes with buying or selling a house.

They can also answer questions about the local housing market and provide advice on things like taxes and financing.

Realtors® are held to a higher standard than non-realtors and agree to the Code of Ethics and Standards of Practice of the National Association of REALTORS®.

Leave a Reply

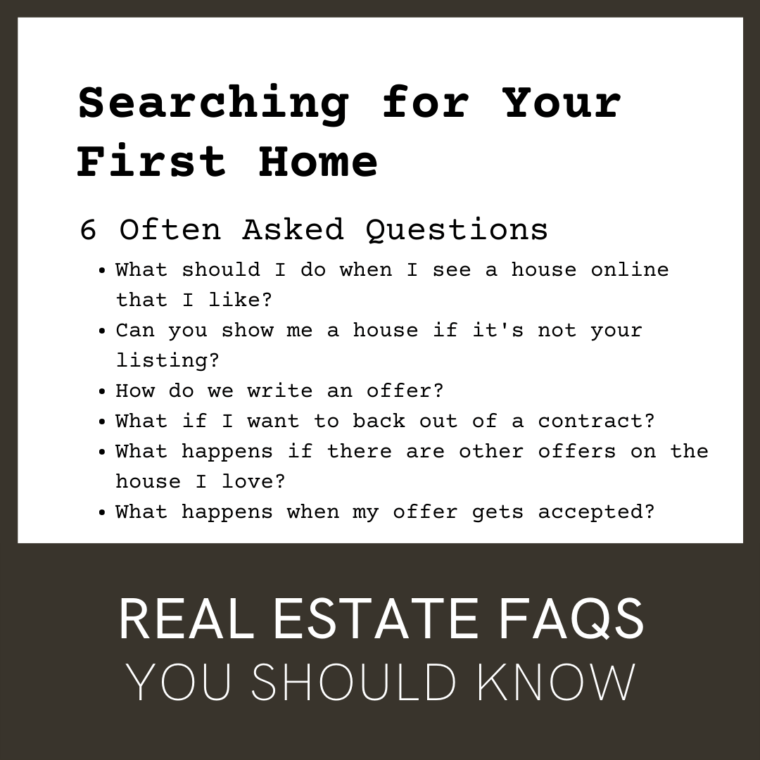

Here are 6 questions and answers about looking for your first home to buy.

What should I do when I see a house online that I like?

Call the agent you are working with to find your home. It’s best that you work with one real estate agent throughout your search because that person learns what you like and dislike and will invest a lot of time vetting properties for you. That person also represents your best interests only. When you call the agent advertising the home, you are dealing with the seller’s agent, so, while they can assist you, they are also trying to get the best price for the seller.

Can you show me a house if it’s not your listing?

Yes, I can show you any house listed in our MLS system. As mentioned above, working with me as your agent ensures that your interests are protected.

How do we write an offer?

When you find the property you want to make an offer on, I will run a Comparative Market Analysis (CMA) to help you determine a fair offer amount. I will also guide you through the additional terms of the contract, such as the escrow amount, closing date, and any additional terms you want to be added to the offer. I will write the offer on a contract form and submit it to the seller’s agent.

What if I want to back out of a contract?

You always have the right to back out of the purchase, but you may lose your escrow deposit. If the contract is contingent on a property inspection, you usually have the right to cancel for any reason during the inspection period. Once the inspection period has passed, you cannot back out and keep your deposit unless the seller agrees, or an additional term has not been met.

That said, the ability to back out of a contract will depend on the details of the offer and the specifics of the contract. We will discuss these details before submitting an offer.

What happens if there are other offers on the house I love?

If a seller receives multiple offers on their home, usually their agent will inform the buyer’s agent that multiple offers have been received and the buyers have another opportunity to alter their original offer to present their “highest and best” offer.

Keep in mind that many factors may influence the seller in addition to the offer price, such as the down payment amount, closing date, and inspection terms.

What happens when my offer gets accepted?

Once both parties have agreed on all terms and signed the contract, your escrow deposit must be made and you should schedule the home inspection. Your lender will receive a copy of the contract and will begin processing your mortgage application.

Your agent will further discuss the full process with you at that time.

Leave a Reply

What are seller concessions?

They are incentives to motivate buyers to purchase a home.

Seller concessions, also known as seller contributions or seller-paid closing costs, refer to financial incentives that a home seller may offer to a homebuyer to help them cover some of the expenses associated with buying a home.

These concessions are typically negotiated as part of the sales contract and can take a variety of forms, such as paying for some or all of the buyer’s closing costs, providing a credit toward the buyer’s down payment, or offering to pay for repairs or improvements to the property.

Leave a Reply

What is a Seller Disclosure?

A Seller Disclosure or Disclosures provide Information about the property about significant renovations, water damage, pest damage, etc.

The required disclosures vary by state, so be sure to talk about this with your agent.

Leave a Reply

What is a Settlement Statement?

A settlement statement, also known as a HUD-1, is a document that lists all the costs associated with buying or selling a home.

It includes the purchase price, loan fees, taxes, insurance, and any other costs that need to be paid at closing.

This document will be given to the buyer and seller at the closing of the real estate transaction.

Really good agents will also send you a copy of your HUD-1 right before tax time to make sure you take advantage of any tax-deductible expenses from the purchase or sale of your home.

Leave a Reply

The property is Sold

The property has been sold and is off the market. The transaction has been completed and the new buyers own the home.

The property is no longer available to purchase or take offers on.

Time to look for another home to buy.

Leave a Reply

What does Temporarily off the market (TOM) mean?

The owner has decided to take the listing off the market for an undetermined amount of time. Typically, this is because work is being done, or the home is unavailable for showings at the time.

Usually, the home will be back on the market in the near future. If not, the listing status will go to Cancelled.

Leave a Reply

What is the Title of a house or property?

Title (aka Title Deed) refers to the legal document that shows the history of ownership and transfers of property – proving you are the current and rightful owner of the property.

A title, also known as a title deed, is a document that shows who owns a piece of property.

When someone buys a house, they get a title deed that shows they are the owners.

The title deed has the names of the people who bought the house and is signed and notarized so it is legally valid.

Leave a Reply

What is Title Insurance? 🤔

Most lenders require title insurance, which protects them from claims such as liens, easements, and flawed records that can come up even years after a transaction.

💡 TIP: Buyers can also purchase their own “owner’s title insurance,” a one-time fee that protects them from any financial burdens, such as back taxes.

Although you may cringe at another cost, this is an important one that protects your ownership rights!

Our best advice? Contact our team for a ✨ free consultation ✨ to ensure you don’t miss any critical legal requirements if you’re buying or selling!

Leave a Reply

A townhouse is a type of housing where several people own separate units in a larger building or complex. Each unit is owned by an individual and the common areas, such as the lobby, pool, and gym, are shared by everyone who lives in the building.

Townhouses are often popular because they are usually smaller than single–family homes and offer amenities like a pool or gym that single–family homes don‘t.

What is the difference between a condo and a townhouse?

A condo is a type of housing where several people own separate units in a larger building or complex. Each unit is owned by an individual and the common areas, such as the lobby, pool, and gym, are shared by everyone who lives in the building.

A townhouse is similar to a condo, but it is usually smaller and more like a single–family home. Townhouses may have more amenities like a private backyard or a garage.

Leave a Reply

What is a Contingent Offer?

In real estate, a contingent* offer is an offer made on a property, which says that certain conditions must be met in order for the sale to be completed.

These contingencies usually involve the home appraisal (the home value determined by an appraisal), home inspection, and receiving approval for your mortgage.

They may also include an offer contingent on the sale of the home the buyer (you) needs to sell before purchasing the new property.

Contingencies offer important protection for home buyers and are rarely waived.

Should I accept a contingent offer on my house?

If you are both buying and selling, should you take a contingent offer on the property you are selling? Typically, the answer is yes. But this is a decision you should discuss thoroughly with your Realtor®. Every situation is unique, so having an experienced agent is essential for determining if this is the right move for your situation.

* Contingent – occurring or existing only if (certain circumstances) are the case; dependent on.

Leave a Reply

What does Withdrawn mean?

The listing was withdrawn from the market by the owner. This could be for various reasons: The owners may have decided they do not want to sell anymore, or maybe they didn’t like the offers they received.

Leave a Reply

Home Sellers

An Active Property

The property is actively for sale and on the market. The sellers may have received offers but have not accepted any yet.

When an offer is accepted the property will become Pending the completed sale.

If the contract falls through, typically the property will go Active again.

Leave a Reply

A professional analysis used to estimate the current value of the home in the real estate market.

This is a necessary step in validating a home’s worth to you and your lender as you secure financing.

All parties to the transaction hope the appraisal will come in at the same amount as the listing price.

If the appraisal comes in low, your options include backing out of the sale, having your agent appeal the low value, paying the difference in value in cash, and renegotiating the offer.

Leave a Reply

What does As-is mean?

A contract or offer clause stating that the seller will not repair or correct any problems with the property. Also used in listings and marketing materials.

In other words, selling a house as-is means that a buyer will get the property in its exact, current condition without any additional repairs or upgrades.

Leave a Reply

What is a backup offer?

When an offer is accepted contingent on the fall through or voiding of an accepted first offer.

Sellers may accept backup offers if they are not confident about the offer they have accepted.

Consider it a safety net for the seller if the current offer does not close.

There are also benefits for buyers.

Although it might seem like a long shot, putting an offer on a house that’s under contract actually has a reasonable chance of scoring you a home. Deals fall through for all kinds of reasons, so if you’re in the backup position, you’ll lock things in and keep a home from going back on the market.

As usual, discuss putting in a backup offer with your Realtor.

Leave a Reply

Close of escrow is the final step in the real estate transaction. It is when the buyer pays the seller for the property and all the documents are signed.

After close of escrow, the title deed is transferred to the new owner and the keys are given to the buyer.

The escrow company then sends the money to the lender and all the parties involved in the transaction.

Leave a Reply

Closing: The end of a transaction where documents are signed, and funds are dispersed.

Leave a Reply

Closing costs are the fees that the buyer and seller will owe associated with the home-buying process, such as the real estate brokerage commission and title insurance.

Most are paid by the buyer, but the seller pays for some.

The fees will vary with each transaction. Your lender or title rep will let you know what the fees are and how much you will need at the close of escrow.

The fees required to complete the real estate transaction include points, taxes, title insurance, financing costs, and items that must be prepaid or paid through escrow.

Leave a Reply

What are Comparable Sales?

Known in real estate as “comps,” comparable sales are the sales prices of similar homes and are based on the following:

When it comes to buying or selling, both place high importance on comps to determine a home’s value.

Contact our team for a

Leave a Reply

Comparative market analysis or competitive market analysis, aka CMA, compares the sales price of similar properties in the area to help determine the price of a property.

A CMA estimates a home’s price based on recently sold, similar properties in the immediate area. Real estate agents and brokers create CMA reports to help sellers set listing prices for their homes and help buyers make competitive offers.

If you need more details about CMAs, read “What Is Comparative Market Analysis (CMA) in Real Estate?“.

Not to be confused with Country Music Awards. 🤓

Leave a Reply

What is a Contingency?

A provision of the contract that keeps the agreement from being fully legally binding until a certain condition(s) is met.

For example, the purchase of a home can be contingent upon the buyer selling their home first.

Every real estate contract includes space for “contingency clauses,” or conditions put forth by the homebuyer and home seller that must be met for the transaction to close.

Here are some types of contingency clauses you might see in your next home sale…

📝 Home Inspection / Due Diligence

📝 Cost-of-Repair

📝 Appraisal

📝 Financing or Mortgage

📝 Sale and Settlement

Contingency clauses can be tricky to navigate, which is why it’s always a good idea to have a licensed real estate professional guide you through the process.

We know this lingo inside and out, so reach out if you’re thinking about buying or selling a home soon!

Leave a Reply

In real estate, a contingent offer is an offer made on a property, which says that certain conditions must be met in order for the sale to be completed.

Leave a Reply

A real estate contract is a legally binding agreement between two parties for the sale and purchase of a property.

It outlines the price, terms, and conditions of the sale. It also includes any other agreements that the buyer and seller have made, such as repairs that need to be done before the sale is completed.

All real estate contracts must be written and signed by both parties.

Leave a Reply

Conventional sale: When the property is owned outright and has no mortgage.

Conventional sales are often smoother transactions than those that require financing as there is no dependence on the buyer receiving a loan to purchase the property.

A conventional sale is not to be confused with a conventional loan. In this instance:

“Conventional” just means that the loan is not part of a specific government program. Conventional loans typically cost less than FHA loans but can be more difficult to get.

This may sound confusing, so just ask your Realtor to explain it to you if you’re not clear. ☺️

Leave a Reply

A counteroffer is a response to a buyer’s original offer on a house to make changes that better fit a seller’s goals.

A counteroffer is one step closer to an accepted offer!

A counteroffer shows that the seller is willing to work with the buyer, but on slightly different terms (usually a change in the price or contingencies).

Here’s how your real estate agent can help you navigate a counteroffer:

☑️ Buyers, we negotiate on your behalf and provide guidance on how to get your offer accepted.

☑️ Sellers, we help you stay clear of red flags and make sure you accept the right offer.

Negotiation is a BIG part of what we do as real estate pros! Connect with our team to learn more about how we provide 5-star representation for our clients.

Leave a Reply

Days on market (DOM) means the number of days a home has been listed on the market.

The number of days the property has been on the market may reflect the desirability and/or pricing of the home.

If the home has been on the market too long, the property may be stale.

Leave a Reply

What is a Disclosure Statement 🤔

Also known as a “Seller’s Disclosure,” this is a legal document that outlines any known flaws that a home seller is aware of that could negatively impact the home’s value 🏡

💡 TIP: Buyers should scrutinize this document closely with their real estate agent to fully understand the condition of a home.

Our best advice? When it comes to buying a home, make sure you get an inspection to confirm what has been disclosed is accurate and discuss any potential deal breakers with your agent.

Contact our team for a ✨ free consultation ✨ to learn more about what you must legally disclose if selling and how to ensure you don’t miss any important information if you’re buying!

Leave a Reply

The representation of opposing principals (buyers & sellers) at the same time.

That is, one real estate agent represents both the buyer and the seller in one transaction (sale of a home).

Leave a Reply

What is Earnest Money? 🤔

A deposit made to a seller that represents a buyer’s good faith to buy a home. It’s typically around 1% – 5% of the sale price.

Earnest money is a deposit from the buyer to the seller, made in good faith to show dedication to purchasing the property 🏡

IMPORTANT FACTS 👇

💰 The amount varies by market

💰 Goes towards the purchase of your home

💰 Protects the seller if a buyer backs out

💰 A buyer may get this money back – due to failed inspections or contingencies

💡 TIP: In a seller’s market, you may consider making your earnest money non-refundable.

Our best advice? When it comes to buying in a low inventory, competitive market, it’s essential to partner with a Buyer’s Agent who understands how to make your offer stand out to sellers 🥊

Leave a Reply

What is an escalation clause?

An escalation clause is a clause in a real estate contract that allows the purchase price of a property to increase if a certain condition is met.

For example, if the buyer and seller agree to an escalation clause and the market value of the property increases, the buyer will have to pay more for the property than originally agreed upon.

This clause is typically used when two buyers are competing to purchase the same property.

Leave a Reply

What is a Listing?

In real estate, the word “listing” is typically used to refer to the for-sale home or property itself, although it technically means the agreement between the broker and the owner of the home to market and sell the property.

This is not the same as listing the property on the MLS (Multiple Listing Service).

Leave a Reply

What is a Listing Agent?

The real estate agent who represents the home seller during a real estate transaction.

Leave a Reply

What is the market value of a home?

The highest price in terms of dollars that a property will bring in a competitive and open market.

Leave a Reply

What is the MLS?

MLS stands for Multiple Listing Service. They collect, compile and distribute all information about homes listed for sale.

The MLS is the organization real estate brokers use to search for and list properties for their clients.

Membership isn’t open to the general public, although selected MLS data may be sold to real estate listing websites, like Realtor.com or our own MLS listing search where the public can search the MLS at no charge.

See also the term “listing“.

Leave a Reply

What are Natural Hazards Disclosure Reports?

Natural hazards disclosure reports are reports that tell potential buyers about any natural hazards near a property.

These hazards can include things like flooding, earthquakes, and wildfires.

The report will also include information about potential risks associated with these hazards and what the buyer can do to protect their property.

The report is usually provided by the seller before the sale is finalized.

Leave a Reply

What is an offer to purchase?

Typically just an “offer”, is when a buyer proposes certain terms and presents these terms to the seller.

When you make an offer on a house, you and your agent will discuss the terms of your offer and submit the offer to the home seller’s agent.