So you think you’re finally ready to buy a house, but you have some credit card debt you’re thinking of paying off first. You’re wondering if your credit cards will affect your ability to get a mortgage.

That’s a smart thing to wonder!

Getting your credit in order before you apply for a home mortgage can save you big bucks in the long run, but also help you avoid disappointment from getting turned down by lenders.

When it comes to understanding how credit works, there is a lot to know and understand, so in this article, we’ll just talk about credit in relation to your credit cards.

One of the most important things to know it the better your credit, the less you’ll pay for your mortgage.

Start out by getting a free credit report and score from CreditKarma.com or CreditSesame.com. Both sites are free to join and you can check your credit as often as you want without affecting your credit score. When you apply for a new credit card, a car loan, or a home loan, you’ll get what’s called a “hard inquiry” on your account. These hard inquiries can affect your score negatively and you want to avoid them as much as possible, especially when you are thinking of applying for a mortgage.

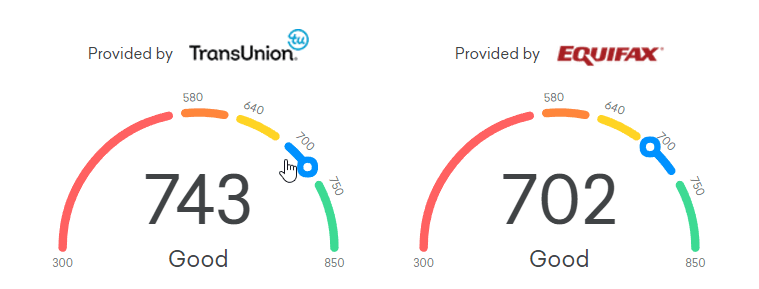

Once you have your credit score (aka Fico Score) and report, you need to understand that not all lenders will use the same methods to determine your credit score. So just because you have a good score of 720, doesn’t mean that is the score your lender will use. There are a variety of credit models that different lenders use, and the only score that really counts is the one your lender uses. So, for instance, CitiBank may give you one score, while Wells Fargo may give you a very different score. In addition, there are 3 main credit bureaus that track and report your credit scores differently, Experian, Equifax, and TransUnion. The bottom line is, good credit scores are earned, not given.

Here are a number of factors that make up your Fico score

- Your payment history – do you pay on time?

- Debt utilization – how much of your credit do you use?

- Length of credit history – how long have you had your credit cards?

- Types of credit – do you have other types of credit like a car loan or personal loan?

- Inquiries for new credit – do you frequently apply for new credit cards?

Here’s how to manage those credit factors:

- Always make your payment on time, or early. Avoid paying at the last minute.

- Keep your debt utilization to 30% or lower. In other words, if you have a credit limit of $1000, avoid having more than $300 charged at a time.

- The longer your credit history, the better. So even if you have cards that you have paid off, do not cancel the card! They add to the length of your history.

- A variety of types of credit and credit cards from different banks can make you a more attractive borrower.

- Again, avoid applying for credit for the sake of it, or just to get a new credit card.

It’s a delicate balance of establishing your credit, and not using it too much. Sounds pretty counter-intuitive to me, so it’s easy to make mistakes.

So now you know your Fico score and some of the basics on what your score is based on. What should you do to get ready to apply for your mortgage?

Here are some guidelines to follow:

Avoid charging more on your credit cards, keep the balances as low as possible.

Don’t apply for, open or close any credit accounts.

Do NOT buy a car, a boat or an RV. If you want to qualify to buy a house, that needs to be your top priority with your credit. And please don’t buy anything for your new home until the deal is done and you’re moving into your new house.

Don’t cosign any loans for friends or family.

Don’t do any debt or credit card debt consolidation.

If there are any discrepancies on your credit reports, try and sort them out before you apply for a mortgage.

If you’re not sure what to do, ask a trusted financial advisor or lender. If you don’t have a lender you trust, ask for a referral from you real estate agent. Having someone to work with who has your best interests at heart will save you time, money, and heartache.

Keep in mind that this article is not the end all be all in credit advice. I guarantee your needs and circumstances will vary. The best way to take care of yourself financially is to do your homework, learn as much as you can, then consult a professional. If something doesn’t sound right or feel right, get a second opinion.

And of course, here is our disclaimer.

Leave a Reply