To Rent or to Buy, that is the question.

– William Shakespeare

OK, Bill Shakespeare never said that, but if he were alive today, he might. 😉

Since there is no one answer to the question, “Should I buy a house, or continue to rent a house (or apartment)”, we will try and give you some things to consider before you decide.

The first thing that probably comes to mind is, how much will it cost to buy a house compared to renting the same house. Well, there are a lot of other considerations before you even think of price/cost/expenses. So let’s dive into those first, then we’ll circle around to the subject of money.

Renting vs Buying – Pros and Cons

There are positives and negatives to both buying and renting. Here are just some of what we can think of, but you can probably add a few of your own to the lists.

Renting

Pros

- Easier to move. With a yearly lease or monthly rent, you can pick up and move relatively easily compared to selling a house if you need or want to move.

- No maintenance costs. Usually, the landlord or property owner picks up the tab for keeping the place ship-shape.

- Low cost of entry. Again, this is relative, but to rent you typically need first and last month’s rent, and a deposit. Buying usually requires more out-of-pocket cash to get started.

- Monthly rent usually stays the same for at least one year.

- Flexibility in housing type. Choose a house, apartment, condo, etc. See what fits your lifestyle the best.

Cons

- There is no return on your investment. You don’t build equity in the property, you are paying the mortgage for the owner.

- The owner or landlord can give you the boot at will. They can sell the property, raise the rent, change the rules, or decide to stop renting the place.

- Many if not most rentals don’t allow pets. If you’re an animal lover, you may have to settle on a goldfish instead of a dog or cat.

- Forget about redecorating. You are probably stuck with the paint color, appliances, and thin walls.

- Although you may rent a place for years, it’s not likely that you’ll make a home out of it.

Buying

Pros

- Pride of ownership. There is something magical about owning your own property. Homeowners tend to treat their own homes with TLC. Not so much with a rental property.

- You can build equity. Typically the value of a home goes up over time, and that equity belongs to you. Not the landlord.

- Get a tax break. Usually, homeowners get significant tax write-offs for things like mortgage interest and certain other expenses. Talk with your accountant about what you qualify for.

- Paint the walls purple! Well, maybe not purple, but you can decorate however you want. Remodel the kitchen or bath, add a deck out back. You don’t need permission from anyone.

- Finally being able to get a dog or cat. Or a bunch of dogs and cats. But remember you have to clean up after them. 😉🐾🐶🐱

Cons

- You’ll need a solid financial position. Enough for a down payment, inspections, closing costs, and some weird fee that always seems to come up at the last minute.

- Along those same lines, you have to qualify for a mortgage which is significantly more challenging than coming up with rent and a deposit. There will be some hoop-jumping!

- With great homeownership comes great responsibility. You’re in charge of maintenance, repairs, mowing the lawn, and that sort of thing. It’s going to take time and effort.

- As with all financial investments, you could lose money. The property value could go down, the home value could decrease, you could end up “underwater”.

- Life happens. Owning a home can get complicated if you need to move quickly, get a divorce, or just get tired of mowing the lawn.

Decisions, Decisions, Decisions

Yes, you’ll need to make a lot of decisions when weighing the pros and cons of owning a home rather than renting.

But besides just the good and the bad, there are other things to think about before venturing out on your journey to homeownership.

1. Are You Really Ready to Move to Your Forever Home?

Even though you may not live in your new home forever, the commitment is similar. If you prefer to move around, travel, and have lots of personal freedom, renting might be your best bet.

But if you’re ready to settle down, have a few kids, or provide a stable living environment for the kids you have (and/or spouses, partners, or significant others), or just want a permanent place you can call home, buying is probably the best option for you. Plan to live in your new home for at least 5 years or so, otherwise, the expense might outweigh the benefits.

Remember that you will have increased responsibility as a homeowner. So be prepared to go all in. Mentally, emotionally, and financially.

2. Can You Really Afford to Buy?

OK, let’s get back to the money thing. To know for sure if you can afford to buy, you have to do the math. If you happen to be in finance, you probably already have the skills, but if not, you’ll really want to speak with a banker or mortgage broker, and a real estate agent.

You’ll need to consider what you are comfortable with paying for your monthly mortgage. Some folks make the mistake of pushing that payment to the limit. We advise you to leave some room for unexpected expenses, emergencies, and maybe some upgrades and new furniture.

You’ll need to know how much of a down payment you’ll need, what the closing costs will be, moving expenses, etc. So again, you’ll have to do the math. And the bottom line is, how much can you qualify for? $250,000? $500,000? Find out before you even think about shopping for homes.

After getting pre-qualified for a home loan, you can decide if it’s too soon financially for you to think about buying. Keep renting for now. But now you know what you need to do to prepare to buy. Congratulations! That is a huge first step.

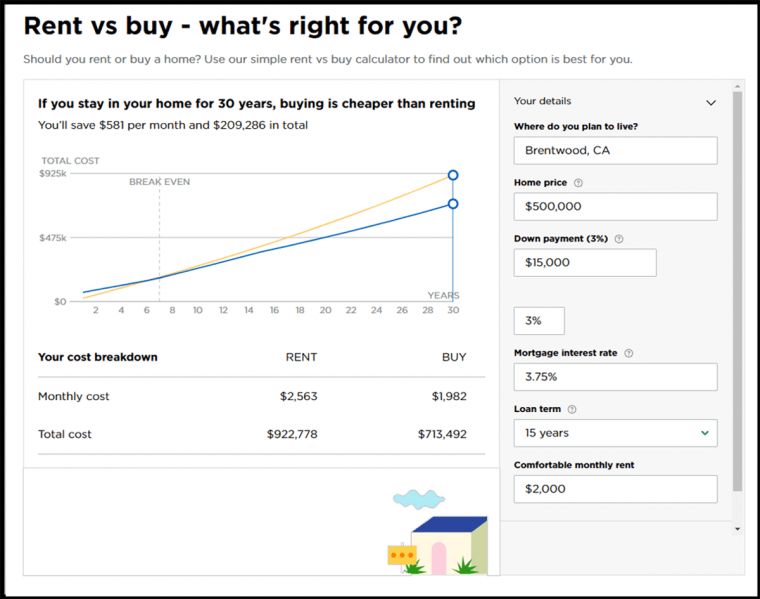

3. What Is The True Cost of Renting vs Buying?

OK, much of what we went over are the short-term considerations. You also need to think about the long run. Especially the financial aspect.

You may want to use a Rent vs Buy calculator to predict where you will stand over time.

Generally speaking, renting is cheaper in the short run, while buying is cheaper in the long run, plus you get the benefits of homeownership that you don’t get with renting.

What is the Cost of Waiting?

Waiting to buy can be expensive too. Right now, mortgage interest rates are incredibly low. Crazy low. 😜 We don’t know how long they will stay this low. So waiting to buy, if you are ready and qualified, could end up costing many thousands of dollars over say a 30-year mortgage.

Home prices are on the rise. We don’t have any way of knowing how long this will last, but there’s no time like today.

Even as I write this, Libby and I are dealing with low inventory and rising prices while we search for our new house in Knoxville. No one is immune! 🤦🏻♂️

We’re not saying that you should be in a hurry, you need to carefully consider everything before you dive in headfirst. But if you’re on the fence, get off and get going.

Our Top 7 Reasons for Buying Instead of Renting a Home

Libby and I have been homeowners for a long time, and we’ve helped well over a thousand clients buy and sell homes. We’ve been in real estate for a long, long time!

So with that in mind, here are our 7 Top Reasons for Buying Instead of Renting

- Pride of Ownership

- Building equity for yourself instead of your landlord

- Building a lifetime of family memories

- Get that dog you’ve always wanted

- Your home is truly yours

- Enjoy a sense of safety, stability, and belonging to a community

- Feel the satisfaction of owning your own home!

Conclusion

Trying to buy a house can be very emotional, and your desire to own your own home is important if not critical to the process. But at the end of the day, it’s really a financial decision.

Once you have decided that homeownership is right for you, right now, get together with a mortgage broker and a Realtor that you trust, and decide if it makes money sense to buy right now.

Know exactly what your budget is before you go looking for homes. Don’t look at homes you can’t afford. That’s the fastest way to frustration and heartbreak. 💔

In order to buy the house you want, you may have to relocate to a new community.

Understand that this is a process, and it will take some time and effort. Stay positive and focus on the end result.

We wish you the best of success along your journey to homeownership!

Leave a Reply