Who’s Checking Your Money ‘Cred’?

Maybe your ‘Street Cred’ isn’t too important to you, but your credit score should be. So, who IS checking your credit? That depends on what you – or your children – are shopping for, applying for or doing online.

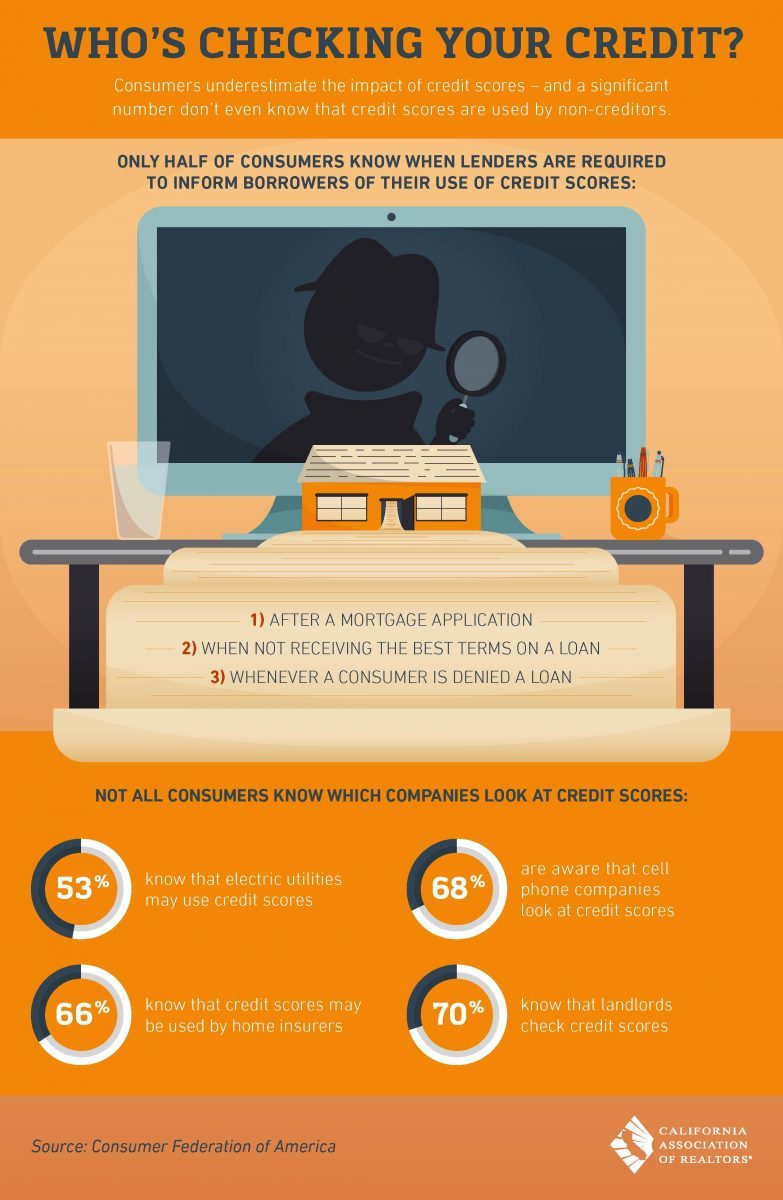

Just because you aren’t currently trying to get a mortgage or refinance your loan, doesn’t mean that your credit isn’t being looked at. And more importantly, your credit score is always important to your financial health. So, besides mortgage lenders, there are loads of other creditors and non-creditors that may be looking at your credit. Shopping for a new smartphone? Even if you pay cash for the phone, the service provider may run your credit to make sure you can afford the monthly plan or contract.

Who Else Besides Banks Check Your Credit?

It’s actually a pretty long list, so we won’t try and cover every possible circumstance. The list is especially long for your kids if they are heading off to college or just starting life on their own away from the safety of the nest.

[Tweet “Heading off to college? Check this vital information about your #credit! via @guthriegrouphms #creditscore”]You may want to share this article with your children so they can plan in advance.

In no particular order…

- Landlords – this is common for both apartment buildings and privately owned homes, condos and townhouses.

- Utilities – telephone, internet, cable TV, gas, water, garbage, and electrical utility companies may run your credit and/or ask for a substantial deposit.

- Cutting the cord? – Hulu, Netflix, Sling TV, and others will want to check your credit score.

- Auto – thinking about buying a new or used car? Great credit will get you great rates, just like with a mortgage.

- Cell Phone Companies – any wireless device that uses Verizon, ATT, T-Mobile and the like will check your credit before selling you anything.

- Background checks – applying for a new job? Count on a background check, including a credit check and a thorough Google search of your name.

- Verification of identity – financial institutions such as credit unions or stock brokerage may check.

- Renting a car – even though they may ‘Try Harder’ or ‘Will Pick You Up’ doesn’t mean they won’t ask for a valid credit card, and they may run your credit too.

- Banks – opening a checking, savings or money market account may induce a credit check.

- Amazon.com – store credit cards, including a variety of types of credit on Amazon, require a credit check and are often serviced by a bank rather than the store itself.

- Credit card companies – if you’re applying for a new card or requesting a credit limit increase.

- Credit card companies (again) – will pull a ‘soft inquiry’ before they send you those damn ‘You’re Pre-Approved’ credit card solicitation letters.

Suffice it to say that if you are alive and you’re over the age of 12, your credit is vital to most everything in life.

Here are a few things to consider besides WHO is checking your credit.

Your credit score may determine the amount of credit you qualify for as well as the interest rate you pay. Keep tabs on your credit score with a free service like CreditKarma, or a paid service through one of the “Big Three” credit reporting agencies, Equifax, Experian, and TransUnion.

Plan ahead if you are going to make a major purchase, you need to move in the near future, or the kids will be leaving home in the next year or so.

Pay attention to this one, it may save you serious heartbreak later. Companies that issue credit to you (like Citibank, Chase, and PayPal), may not use the same scoring methods that are used and reported to you by CreditKarma, Equifax, Experian or TransUnion. So for instance, if Experian tells you your score is 739, the company that you are trying to get credit from may use a different scoring method that gives you a credit score of 679. 🙁 Unfortunately, there’s nothing you can do about this. It’s up to the bank or lender to decide how it judges your creditworthiness.

Conclusion

Do the best you can to keep your balances low on your credit cards, make your payments on time, and don’t borrow money or finance items you can’t afford. And of course, teach your children how to be credit smart.

Do you have questions about your credit, your mortgage or what it takes to purchase a house? Call Libby Guthrie today at 925-628-2436.

Leave a Reply