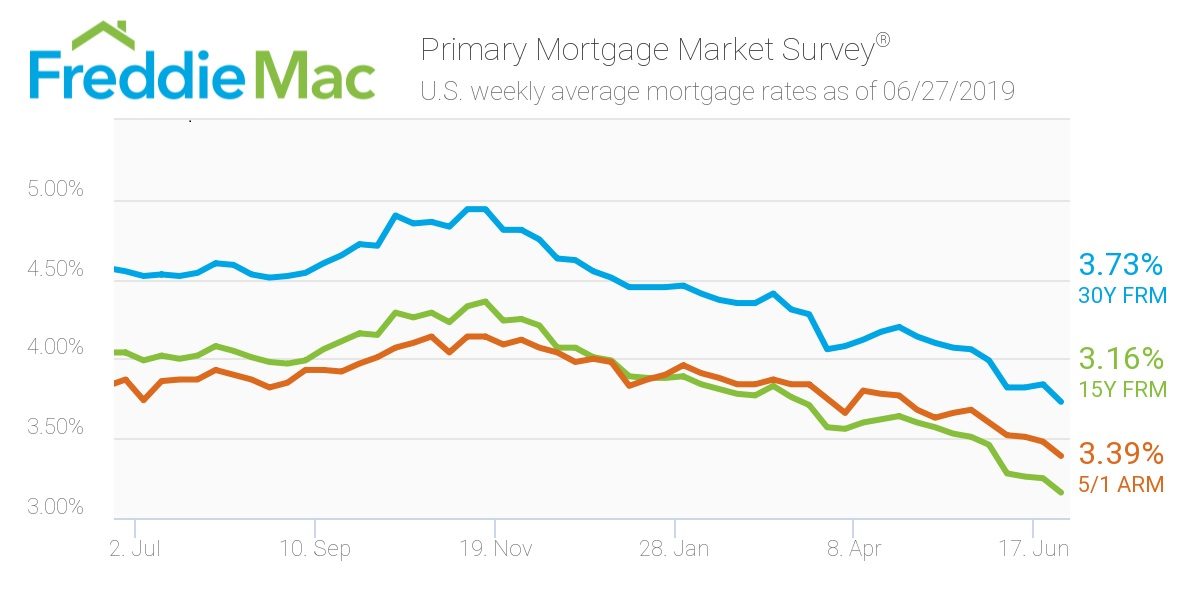

In the past nine weeks, mortgage rates, 30-year fixed rates, in particular, have dropped seven times. This is the lowest average since November of 2016, as reported by Freddie Mac.

Sam Khater, Freddie Mac’s chief economist, says;

While the industrial and trade-related economic data continues to dominate the news, the drop in mortgage rates over the last two months is already being felt in the housing market. Through late June, home purchase applications improved by five percentage points compared to the previous month. In the near-term, we expect the housing market to continue to improve from both a sales and price perspective.

What This Means for Buyers

If you’re a first time home buyer or planning on a move, part of your buying power depends on the cost of borrowing money in the form of a mortgage loan. The lower the rate, the higher your potential buying power.

The chart above shows the trending average 30-year fixed-rate mortgage (in blue), the average 15-year fixed-rate mortgage (in green), and the average 5/1 adjustable-rate mortgage. I’ll explain the difference between these 3 basic loans.

The 30-year fixed is just like it sounds. It’s a loan that is amortized* over 30 years and the interest rate does not change during that time. This is the most common type of mortgage loan.

The 15-year fixed is similar in that the loan is amortized over 15 years rather than 30, and the interest rate stays the same during the life of the loan. The payments are considerably larger for this type of loan, but the amount of interest paid over the 15 years is much less than for the 30-year loan, typically saving the buyer thousands of dollars.

A 5/1 ARM is an adjustable-rate mortgage but the first five years the rate is fixed. After 5 years at the low initial rate, the interest rate usually rises and is adjusted usually once a year.

All these loans are what is known as “conforming” loans, which means the highest loan amount for purchasing a home is $484,350 (which just increased from $453,100).

The other type of loans with higher loan limits are called “jumbo” loans. We won’t be considering jumbo loans in this article.

OK, let’s get back to buying power.

Hypothetically speaking, if you could qualify for the best mortgage rate for a 30-year fixed loan at 3.73% and your monthly budget for your mortgage payment was $2000, you could afford to borrow $433,000 to purchase a home. But if the rate was just one point (1 point = 1%) higher, your buying power would only be $384,300, or almost $49,000 less. So you can see, the lower the mortgage rates, the more house you can afford to buy.

So if you’ve been on the fence about buying your first home, or moving up, now might be a good time to look into it.

But please consider this, the example above is just for illustration purposes. The loan rate you can actually qualify for will probably be different. That said, the idea remains the same. You have more buying power when the rates are low!

What This Means for Sellers

Sellers, this is also good news for you. When potential buyers can borrow more, they tend to do that, which means they also tend to buy more expensive houses. It also means there tend to be more buyers in general. Again, this is good if you’re trying to sell your home.

Generally speaking, when mortgage prices go down, home prices go up. Take a look at our market stats reports to see how prices and the inventory of homes on the market have shifted so far this year.

If you’re curious about this affects the value of your home, we would be happy to create a comparative market analysis (CMA) for your property.

What This Means for Homeowners

There are 2 key benefits for homeowners. First, with prices rising, your equity may also be rising as well. However, this is not guaranteed as we are seeing more REO’s and short sales coming on the market. It’s a good idea to know where you stand with your equity, and we urge you to periodically get your home valuation done.

One very important note here, PLEASE don’t rely on a Zestimate. They are notoriously wrong with their values. They (Zillow) report the median error in California is 1.8% which means they’re off by $9,000 on a $500,000 home. Ouch! And we’re not talking in your favor. I guess you’d call that an over-zestimate…

Please consult your Real Estate professional to get an accurate value of your home.

The second possible benefit is you may benefit from refinancing your current home loan. CNBC reports that the average borrower could save about $266 a month. Your potential saving will vary.

Call your mortgage lender and ask them to see if you qualify for a lower rate and payment. You might even consider switching from a 30-year to a 15-year mortgage if you can.

A Word of Caution

We’ve just described how things are looking better for buyers, sellers, and homeowners. The numbers add up and the stats support it. That being said, this doesn’t mean that buying, selling, or refinancing is right for you. And you are who we care about.

Talk to your Realtor®, Lender, or other professional before you make any decisions about the topics presented here.

If you don’t have an agent or mortgage lender to talk to, we can help you with that. Just give us a call and we’ll take care of you.

* Amortize means to “reduce or pay off (a debt) with regular payments.”

Disclaimers

If your home is currently listed or you are a buyer represented by another real estate agent, this blog post is for informational purposes only.

It is not our intention to solicit the offerings or clients of other real estate agents or brokers.

The above article references an opinion and is for informational purposes only. It is not intended to be financial advice. We are not lawyers, lenders, or financial advisors. Consult the appropriate professionals for advice regarding your individual needs. With regard to referrals, we urge you to perform your own due diligence before hiring anyone or any company.

All information on this site is deemed reliable, but not guaranteed.

Leave a Reply