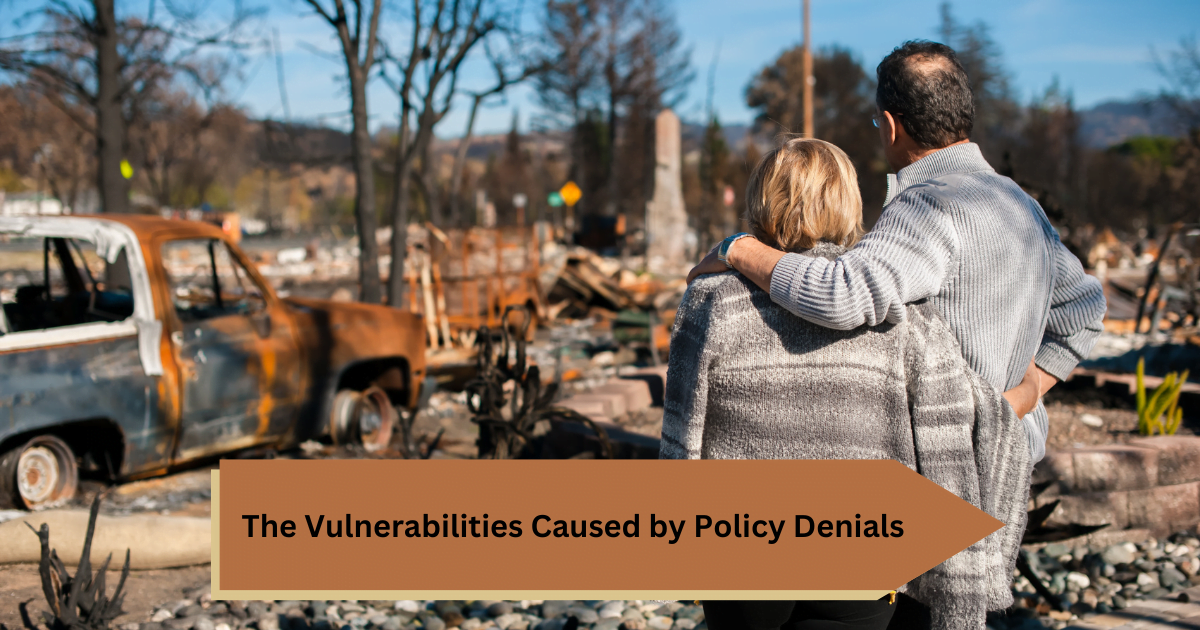

Take a closer look at the storm that new homeowners in California and Florida are facing as insurance companies deny writing insurance policies.

Understand the vulnerabilities caused by this crisis, learn about the reasons driving policy denials, and explore actionable steps to protect yourself in the face of this insurance crisis.

Thousands of people in the Bay Area and many more throughout California are in limbo right now in terms of their insurance coverage. Robert Handa reports. 1

As new homeowners in California and Florida embark on the exciting journey of settling into their dream homes, they are unwittingly stepping into a tempestuous storm of insurance policy denials.

These denials not only threaten their financial security but also leave them vulnerable to the whims of unpredictable weather.

Imagine the frustration of investing in a new property only to be denied the insurance coverage you desperately need.

In this eye-opening article, we will peel back the layers of this insurance crisis, shedding light on the reasons behind these denials and offering actionable steps to safeguard yourself against this ever-present threat.

For many new homeowners, the insurance crisis is an alarming reality that casts a dark cloud over the joy of homeownership.

The denial of insurance policies not only exposes them to immense vulnerabilities but also hinders their ability to protect their largest asset – their home.

Whether it’s the coastal risks and wildfires faced by those in California or the hurricane-prone areas in Florida, homeowners are grappling with the unsettling reality that their insurance coverage may not be there when they need it the most.

Consider what’s happened just this year: 2

- State Farm and Allstate, two of the nation’s largest insurance companies, have stopped selling property insurance to new customers in California.

- Farmers, another huge insurer, announced it will no longer offer any new property coverage in the state of Florida. American International Group, or AIG, said it will no longer insure houses along the Florida coastline. Homeowners insurance rates in the Sunshine State are four times the national average, because national insurers have largely opted out of the market, leaving coverage to regional and local insurers that are teetering on the brink of insolvency.

- A fifth of homeowners insurance policyholders in Louisiana have had their provider cancel their policy, according to a 2023 survey by LSU.

What’s driving this upheaval? Climate change. Extreme weather, including devastating California wildfires and costly Gulf coast hurricanes, are forcing insurers to reassess their risk tolerance.

So, what are the other driving forces behind these policy denials? Are insurance companies simply turning their backs on new homeowners, or is there more to the story?

In the following sections, we will explore the reasons fueling these denials, providing a comprehensive understanding of the factors at play.

Additionally, we will equip you with actionable steps to protect yourself and navigate this insurance crisis with confidence.

By the end of this article, you will possess a deeper knowledge of the insurance crisis faced by new homeowners in California and Florida.

Armed with this understanding, you will be empowered to take proactive measures to safeguard your home and family.

We urge you to stay informed, seek legal advice if necessary, and explore alternative insurance options to ensure the necessary coverage for your beloved abode.

The storm may rage outside, but with the right knowledge and preparation, you can weather any insurance-related challenge that comes your way.

Understanding the Insurance Crisis for New Homeowners

To understand the problems caused by denied insurance policies, let’s dive into the reasons behind these denials.

By unraveling the complexities of insurance company actions, we can better grasp the challenges facing new homeowners in California and Florida.

This section aims to explain the core issues and give you the knowledge to handle this crisis effectively.

Why Do Policies Get Denied for New Homeowners?

One significant reason behind policy denials is the perception of higher risk associated with first-time homebuyers.

Insurance companies often see them as more likely to file claims due to their limited experience in homeownership.

This perception of increased risk can lead to denials or expensive premiums, making it hard for new homeowners to get affordable coverage.

Location Matters:

The geographical location of these new homes is another big factor in policy denials. California and Florida are known for natural disasters like wildfires, earthquakes, hurricanes, and floods.

Insurance companies take these risks into account when assessing policies, often resulting in denials or limited coverage for homeowners in these regions.

So, new homeowners in these areas face a tricky situation where the very risks raising insurance costs also leave them vulnerable to policy denials.

Property Condition Counts:

Insurance companies also examine the condition of the property itself.

Even minor issues like old electrical systems, outdated plumbing, or subpar roofing can lead to policy denials or higher premiums.

These companies argue that such problems increase the chances of damage, justifying their actions.

However, these strict rules can hit new homeowners harder, especially if they can’t immediately fix these structural issues.

Taking Proactive Steps:

Given these challenges, new homeowners should take steps to protect their homes and families.

This might involve making necessary renovations or improvements to address concerns flagged by insurers.

Staying informed about local building codes and regulations can also help homeowners navigate the insurance landscape better.

Exploring Other Insurance Options:

While the insurance crisis can be overwhelming, new homeowners have alternative insurance choices.

Checking out different insurers and coverage plans can reduce the risk of denials and provide personalized solutions.

If necessary, seeking legal advice can also clarify homeowners’ rights and potential actions to take when dealing with unfair policy denials.

Knowledge and Preparation Are Key:

In summary, being informed and prepared is crucial to dealing with insurance-related challenges.

Understanding the insurance crisis faced by new homeowners in California and Florida empowers you to take proactive steps to protect your home and family.

Despite external challenges, armed with the right information and proactive measures, you can confidently navigate this crisis.

The Vulnerabilities Caused by Policy Denials

Facing the insurance crisis might seem daunting, but there are alternatives for new homeowners.

Exploring different insurance providers and coverage options can reduce the risk of denials and tailor solutions to individual needs.

By researching and comparing insurance providers, homeowners can discover policies that fit their specific requirements and decrease the chances of denials.

Additionally, seeking legal advice can be helpful when dealing with unfair policy denials.

Consulting with an attorney specializing in insurance law can clarify homeowners’ rights and potential actions to take.

Legal guidance can shed light on the legality of denials and provide advice on how to proceed, whether that means negotiating with the insurer, lodging a complaint, or pursuing legal action.

Ultimately, being informed and prepared is key to tackling insurance-related challenges.

Understanding the insurance crisis faced by new homeowners in California and Florida empowers you to take proactive steps to safeguard your home and family.

Despite external storms, armed with the right information and proactive measures, you can confidently navigate this crisis.

To comprehend the issues arising from policy denials, it’s crucial to understand why insurance companies make these decisions.

By delving into the factors driving these denials, we can uncover the complex problems impacting new homeowners in California and Florida.

This section will explore the underlying factors influencing insurance companies’ choices to deny coverage, shedding light on the challenges faced by homeowners.

Reasons Driving Insurance Companies to Deny Policies

These denials aren’t random; there are clear reasons why insurance companies deny policies. It’s vital for new homeowners in California and Florida to grasp these reasons as they navigate this challenging situation.

By uncovering these factors, we can prepare ourselves with practical steps to safeguard our homes and assets. Let’s delve into the core reasons behind insurance companies’ policy denials.

- Profits – All insurance companies are driven by profits, so if the cost of doing business in a certain state is higher than their desired profit margin, the insurance provider loses the incentive to write new policies in that state.

In California, the average annual home insurance premium is $1,300 today — up 16% from 2019 levels, according to the Insurance Information Institute, a group that represents the insurance industry. As more insurers have exited California’s borders, the state’s FAIR Plan Association, which was established for California homeowners who are not able to find insurance in the traditional marketplace, has seen enrollment numbers approximately double since 2019.

If that sounds like a lot, it’s got nothing on Florida, where the average homeowners insurance premium is now $6,000 — up 200% from 2019, according to data from the Insurance Information Institute. 4

- Climate Change – homeowners insurance providers are definitely not climate change deniers. They recognize that climate change has dramatically increased natural disasters and therefore dramatically increased the amount of insurance claims.

- Extreme Weather – even if you don’t believe in the climate change claims, the drastic increase in weather related disasters in the U.S. are hard to deny. From tornados, hurricanes, wildfires, floods, and excessive heat, Americans are hurting from damage caused by these extreme weather events.

- California’s Consumer Protection Laws – In an effort to thwart insurance companies from price gouging, Prop 103 may be backfiring on the states’ homeowners.

California’s Proposition 103, the 1988 law that required the state’s Department of Insurance to approve property and casualty insurance rates and ordered insurers to “roll back” rates by 20%, was cited as an example during the hearing.

“When you can’t make a profit, you don’t stay in those states,” said Sen. Tim Scott, R-S.C., ranking member of the Senate Banking Committee. “It’s one of the reasons why you see, rather a State Farm, AIG, the insurance companies that we just named, leaving markets. It’s because rates sufficiency is impossible to get there.” 3

Exploring Actionable Steps to Protect Yourself

To protect your new home and assets from insurance policy rejections, it’s crucial to understand what drives these denials.

By looking at the factors that influence insurance companies’ decisions, homeowners in California and Florida can take proactive steps to safeguard themselves.

1. Proper Documentation Matters:

A primary reason behind policy denials is a lack of the right paperwork. Insurance companies often require extensive documents, like proof of ownership, appraisals, and inspection reports.

If you fail to provide these documents or submit incomplete or inaccurate information, your policy may get denied.

So, it’s vital for new homeowners to keep all relevant documents organized and up to date to ensure a smooth insurance claims process.

2. Home Condition and Risks:

Insurance companies also consider your home’s condition and potential risks associated with it.

Things like outdated infrastructure, possible hazards, and being in high-risk locations can lead to policy denials or higher premiums.

To protect yourself, it’s wise to conduct a thorough home inspection before buying a property.

This not only reveals existing issues but also gives you a chance to address them, improving your chances of getting favorable insurance.

3. Home Maintenance Matters Too:

Moreover, insurance companies may deny policies due to a lack of proper home maintenance.

Neglecting regular upkeep, like roof repairs, electrical updates, or plumbing maintenance, can raise concerns for insurers.

Being proactive in maintaining your home and addressing necessary repairs not only ensures a safe living space but also strengthens your case for insurance coverage.

4. Know Your Regional Risks:

It’s crucial to be aware of the unique risks in California and Florida.

Both states are susceptible to natural disasters like wildfires, earthquakes, hurricanes, and flooding.

Insurance companies carefully assess these potential risks for each property, and your coverage may be denied or limited based on them.

Understanding the specific risks in your area allows you to take specific precautions, such as installing storm shutters, reinforcing your home’s structure, or implementing fire-resistant landscaping.

These steps can help reduce potential damages and increase your chances of getting approved for insurance.

Conclusion

In conclusion, new homeowners in California and Florida have the means to shield themselves from insurance policy denials by taking proactive measures.

By ensuring proper documentation, tending to home maintenance, and understanding regional risks, homeowners can bolster their chances of securing insurance coverage.

Being vigilant and proactive in safeguarding their homes and assets provides peace of mind in the face of potential challenges.

It’s evident that the denial of insurance policies poses significant challenges and vulnerabilities for these new homeowners.

However, by understanding the factors behind these denials, individuals can empower themselves to navigate this crisis more effectively.

Staying well-informed is crucial – educating yourself about insurance policy intricacies and seeking legal advice, if necessary, are essential steps to safeguard your home and financial stability.

Furthermore, it’s essential to explore alternative insurance options and actively secure the necessary coverage for your new home.

By diligently considering different avenues, you can ensure that you have the protection you need in case of unforeseen events.

Let’s remember that knowledge is power. As new homeowners, arming ourselves with information, seeking legal counsel when needed, and taking the necessary steps to protect our homes and future are vital.

And also keep in mind that the other 48 states are in jeopardy as well. Just because we are in Tennessee doesn’t mean there’s no risk to us. If you’re in a different state, keep informed about potential insurance changes in your neck of the woods.

And, as the famous quote by Benjamin Franklin goes, “An ounce of prevention is worth a pound of cure.” It’s in our hands to protect our homes.

Together, let’s rise above the storm and create a secure future for our homes and families.

We’re Here to Help

The prospect of not being able to get insurance, or to have your policy dropped, is daunting. It can all be overwhelming to the average homeowner. That’s why you can depend on us to help you “Ride the storm out”.

If you have questions or concerns, just contact us and we’ll be happy to help.

Sources:

- Homeowners concerned amid California’s home insurance crisis

- States May Need to Scramble to Address Possible Homeowners Insurance Crisis

- Senators take up looming insurance crisis as policy issuers flee Florida and California

- Homeowners in California and Florida are running out of options to protect their homes

Leave a Reply