Will the Market Find Its Footing?

Will 2026 be the year buyers stop waiting? Forecasters are split, predicting anywhere from 1.7%1 to 14%2 growth in home sales. That 12-point gap reveals the central question facing the housing market: how much will slightly lower mortgage rates and slowly eroding lock-in effects actually unlock pent-up demand?

Nearly every major forecaster agrees the market will be more active than 2025. But beyond that consensus, predictions diverge sharply on pace and scale. The National Association of Realtors (NAR) expects robust 14% sales growth. Realtor.com sees a modest 1.7% bump. Both could be right for different markets and price points.

For anyone planning to buy, sell, or simply understand their home equity position in 2026, these diverging forecasts matter less than the underlying fundamentals. Mortgage rates should settle slightly lower. Inventory will improve modestly.

Prices will continue rising, though more slowly than recent years. The market is thawing. More importantly, the housing market appears to be returning to the pace and rhythm of more normal conditions after the artificial volatility of the pandemic era.

TL;DR

The 2026 housing market is expected to gradually normalize after pandemic-era volatility. Mortgage rates will likely settle around 6.0-6.4%—better than 2025 but far from pandemic lows.

Home sales may increase 1.7-14% depending on how quickly the lock-in effect eases, while prices are projected to rise modestly (0.5-4%). For buyers, expect slightly more inventory and negotiating power but continued affordability challenges.

Sellers still benefit from limited supply but need realistic pricing and may need to offer concessions. The market rewards preparation and realistic expectations over trying to time dramatic shifts that aren’t coming.

The 2025 Context: Why the Market Stayed Frozen

The 2025 housing market disappointed. Mortgage rates remained stubbornly above 6.5%, suppressing demand and keeping transaction volumes near historic lows.8 As of mid-2025, more than 80% of U.S. homeowners hold mortgage rates below 6%, reinforcing the lock-in effect that has kept many would-be sellers on the sidelines.³

Affordability challenges reached acute levels. The typical first-time buyer aged to 40 years old4, reflecting simple math that monthly payments at elevated rates and prices pushed homeownership out of reach for younger buyers. The market did not crash but did not heal either, with overall transaction volume remaining constrained.

2026 Predictions: Where Forecasters Agree and Disagree

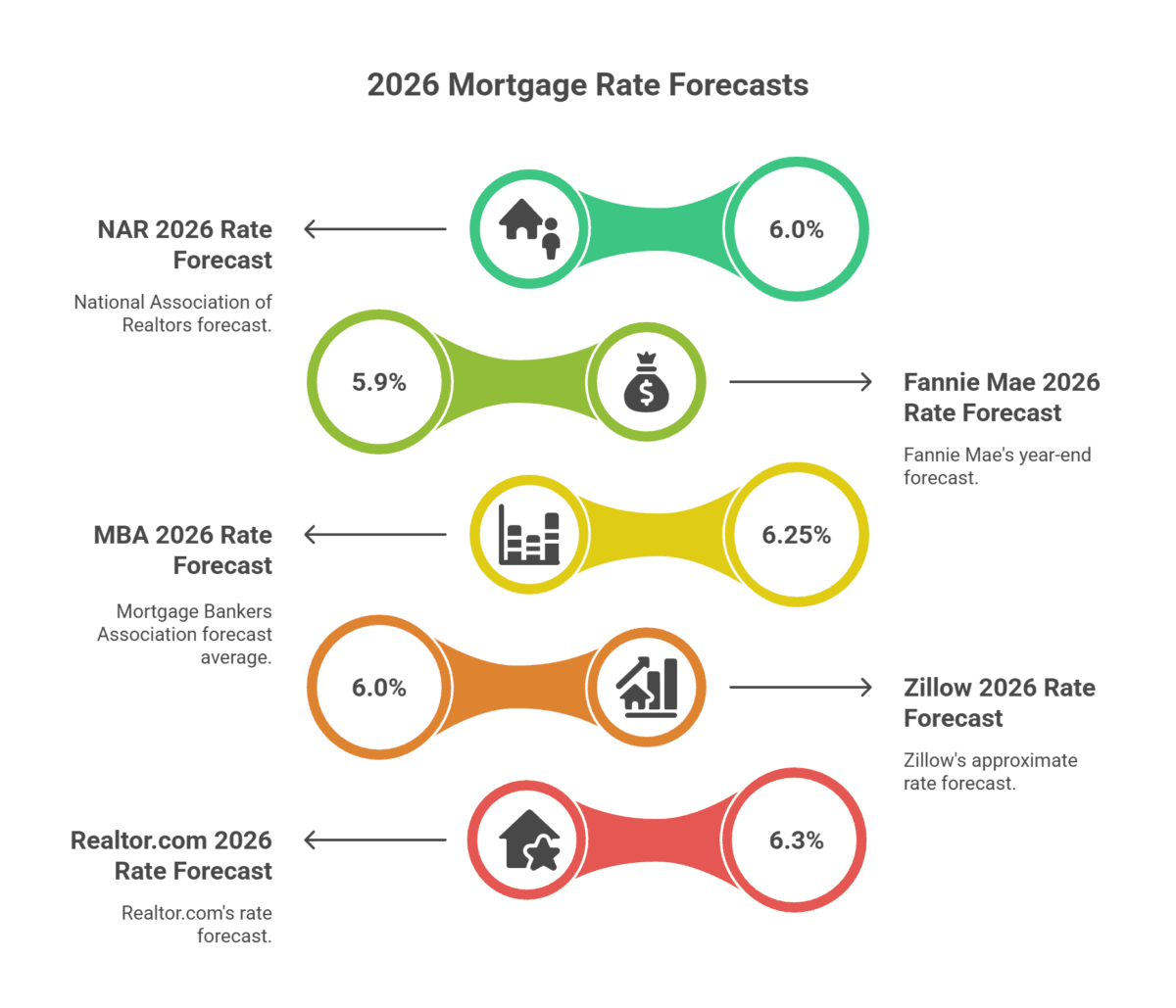

Mortgage Rates: Consensus on Modest Improvement

Forecasters agree broadly on mortgage rate trajectories. Expectations cluster tightly in the 6.0% to 6.4% range, representing modest but meaningful improvement from 2025 levels.

2026 Mortgage Rate Forecasts

| Source | 2026 Rate Forecast |

| NAR2 | 6.0% |

| Fannie Mae7 | 5.9% (EOY) |

| MBA6 | 6 – 6.5% |

| Zillow5 | ~6.0% |

| Realtor.com1 | 6.3% |

This narrow range suggests forecasters see similar Federal Reserve policy paths ahead. While rates in the low 6% range remain elevated by recent standards, they represent improvement that could make a difference for buyers.

The more important question is whether this modest decline triggers meaningful market activity. A drop from 7% to 6.5% means little if buyers continue waiting for 5% or sellers remain locked in at 3%.

The National Association of Realtors estimates that a drop to 6% could unlock 5.5 million additional buyers, including 1.6 million renters.2 But the forecasters’ disagreements on sales volume reveal uncertainty about how big an impact lower rates will have.

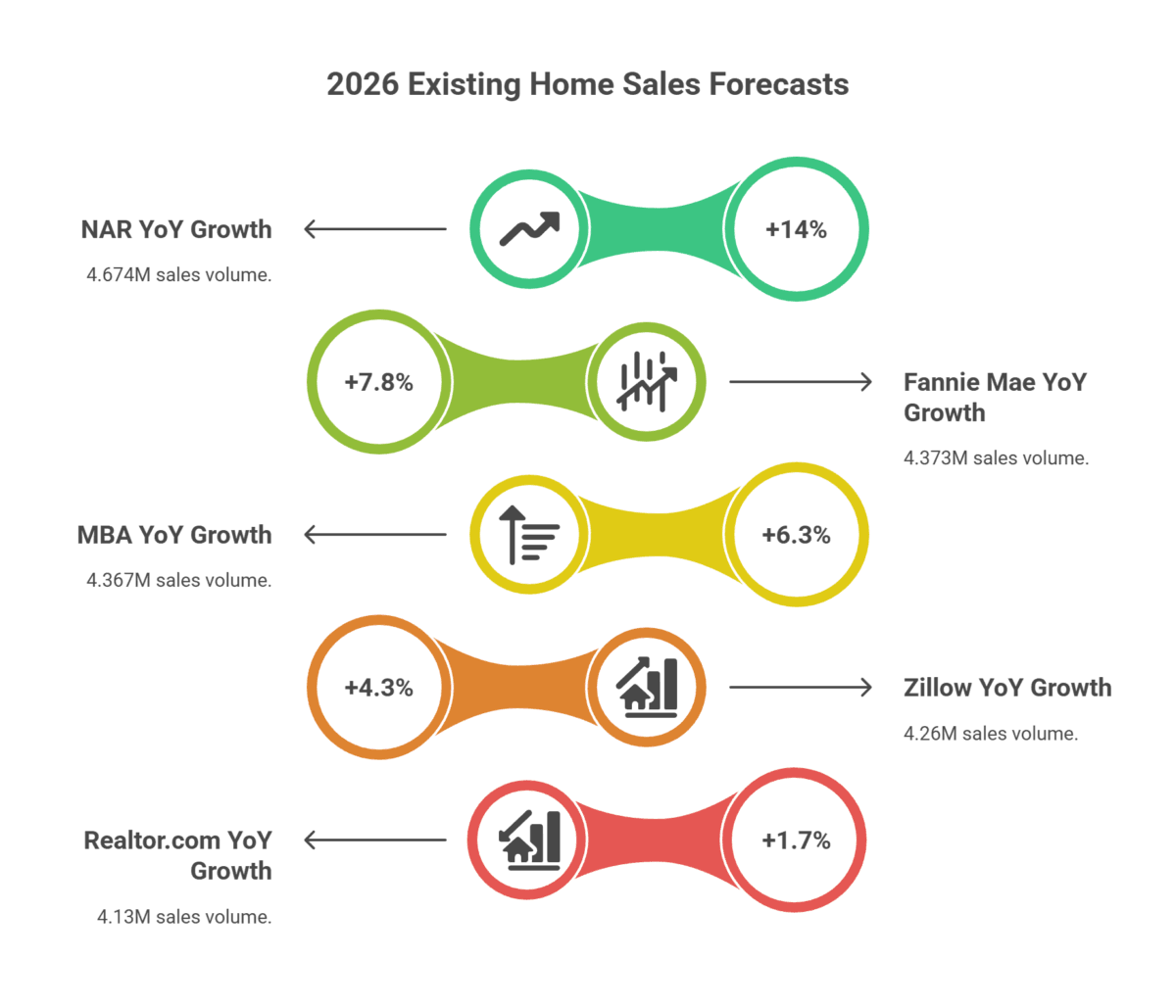

Existing Home Sales: The Uncertainty Factor

Existing home sales projections for 2026 show far more variation than mortgage rate predictions, reflecting different assumptions about how quickly the market thaws.

2026 Existing Home Sales Forecasts

| Source | Sales Volume | YoY Growth |

| NAR8 | 4.674M | +14% |

| Fannie Mae7 | 4.373M | +7.8% |

| MBA6 | 4.367M | +6.3% |

| Zillow5 | 4.26M | +4.3% |

| Realtor.com1 | 4.13M | +1.7% |

This wide range from 1.7% to 14% growth reveals genuine uncertainty about buyer and seller behavior. Will homeowners with 3% mortgages finally accept that rates around 6% represent the new baseline? Will life changes like job relocations, family adjustments, or divorces finally outweigh the financial cost of giving up low rates?

The trajectory depends on several key factors working together. The lock-in effect must continue eroding. As long as a significant percentage of homeowners hold mortgages well below current rates, many will choose to stay put, but this effect will continue to decline as more homeowners reach the threshold where life circumstances outweigh rate considerations.

Buyers also need to shift psychologically from waiting for rates to return to the artificial levels of 2020 toward accepting 6% as normal. Many prospective buyers spent the past two years waiting for dramatic rate declines. However, with 6%-7% now normalized and rates expected to drop further next year, buyers may decide to reenter the market.

Additionally, employment and income stability provide the foundation for both buyer confidence and seller flexibility. Job gains and wage growth give more buyers the financial capacity to proceed with purchases despite elevated rates.

Several forecasters expect slowing price growth combined with continued income gains to gradually improve affordability in 2026.1 Any weakening in employment conditions would likely push sales toward the lower end of forecasts, while sustained strength supports higher volumes.

Even modest changes in interest rates or consumer psychology could swing actual sales significantly within this forecast range. The wide spread reflects genuine uncertainty about these behavioral factors rather than disagreement about underlying economic fundamentals.

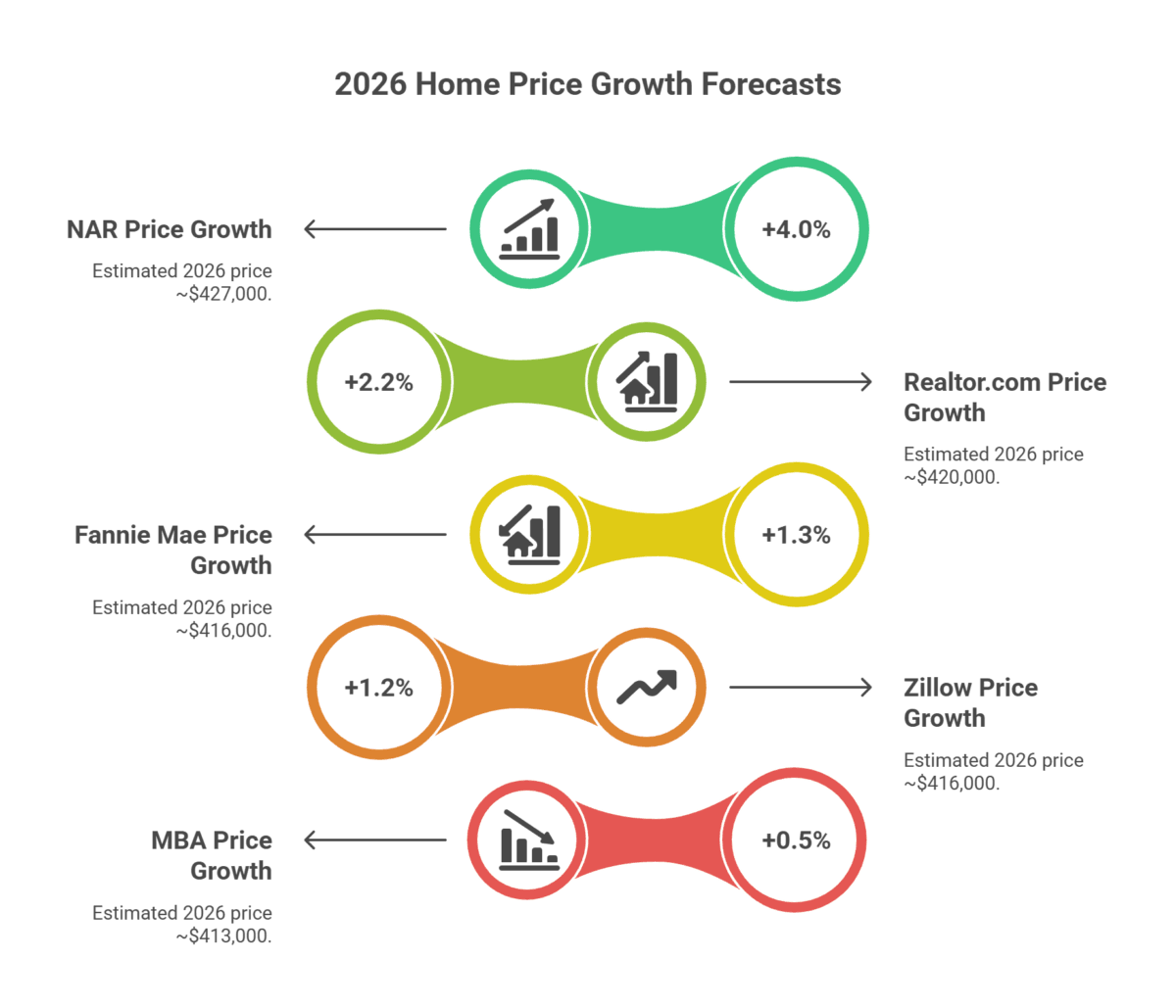

Home Prices: Continued Appreciation Expected

All major forecasters predict continued home price appreciation in 2026, though projections cluster in a relatively narrow band between 0.5% and 4% growth.

2026 Home Price Growth Forecasts

| Source | Price Growth | Estimated 2026 Price* |

| NAR2 | +4.0% | ~$427,000 |

| Realtor.com1 | +2.2% | ~$420,000 |

| Fannie Mae7 | +1.3% | ~$416,000 |

| Zillow5 | +1.2% | ~$416,000 |

| MBA6 | +0.5% | ~$413,000 |

*Based on Q2 2025 median price of $410,800

The relatively narrow range of price forecasts—compared with wider variation in sales volume projections—suggests greater agreement on price direction than on transaction activity. While sales volumes remain uncertain, supply-demand fundamentals continue to support prices.

Housing inventory remains below levels associated with a balanced market, reflecting years of underbuilding relative to household formation. These supply constraints continue to support prices even as transaction volumes remain lower.

Existing homeowners are generally in strong financial positions, with substantial equity accumulated in recent years. This limits forced sales and allows many move-up buyers to deploy equity toward down payments, helping sustain prices, particularly in higher-priced segments.

Price growth expectations for 2026 are modest compared with recent years. The projected appreciation reflects a return to more historically typical growth rates rather than the elevated gains seen during the pandemic period.

What This Means for Buyers

For prospective homebuyers, 2026 presents a complex environment requiring careful evaluation of affordability constraints against the reality that waiting may not yield significantly better conditions.

Accepting the New Rate Reality

Mortgage rates are expected to settle in the 6.0% to 6.4% range in 2026, representing modest improvement from 2025 but remaining well above the unusually low levels seen during the pandemic.

Rates below 3% were driven by emergency monetary policy and are unlikely to return in the near term. Buyers waiting for a drop to 4% or 5% may need to recalibrate expectations, as current forecasts suggest low-to-mid-6% rates are closer to a new baseline.

Planning purchases around these levels provides a more realistic framework, with refinancing remaining an option if rates fall further in later years.

Improved Supply and Buyer Leverage

While housing supply remains below long-term balanced levels, inventory has improved compared with recent years, giving buyers more options and greater flexibility.1 Days on market have lengthened, bidding wars are less common, and sellers are generally more open to contingencies, repairs, and concessions.5

Competition persists for well-priced homes in desirable locations—particularly during spring and summer—but overall market conditions are less frenetic than during the pandemic surge.

Pricing and Competition Dynamics

Home prices are still expected to rise modestly, with forecasts ranging from 0.5% to 4% growth nationally. This means waiting may not lead to meaningfully lower prices, even as rates improve slightly. However, slower appreciation reduces urgency and allows buyers to be more selective.

Homes priced appropriately should continue to sell, but overpricing carries greater risk as buyers gain more alternatives. The market increasingly rewards patience, preparation, and informed offer strategies rather than speed alone.

First-Time Buyer Challenges

First-time buyers continue to face the steepest hurdles in 2026. The median age of a first-time buyer has risen to 40 years old4, underscoring how affordability pressures, higher down payment requirements, and elevated mortgage rates have delayed entry into homeownership for many households.

Even with modest improvements in rates and inventory, upfront costs and monthly payments remain significant barriers, particularly for buyers without existing equity.

That said, conditions may ease slightly compared with 2025. Slower price growth and incremental rate declines reduce some pressure, while increased inventory offers more choice and less competition than in recent years.

Low-down-payment programs, co-buying arrangements with family or friends, and targeting more affordable submarkets can help bridge the gap. While first-time buyers still face meaningful challenges, the 2026 market offers greater flexibility and less urgency than the peak pandemic period, making preparation and strategy more important than speed.

What This Means for Sellers

For homeowners considering a sale in 2026, market conditions remain generally favorable—but seller leverage is no longer uniform. Outcomes increasingly depend on location, price tier, and property condition. Well-priced, move-in-ready homes in desirable areas continue to attract strong interest, while properties that are overpriced or require significant work face longer marketing times and greater buyer resistance.

Evaluating the Mortgage Rate Trade-Off

The lock-in effect continues to influence seller decisions, but the calculation goes beyond comparing a 3% mortgage to a new loan at 6% or higher. Many homeowners now hold substantial equity that can offset higher borrowing costs, particularly for those downsizing, relocating to more affordable markets, or reducing overall housing expenses.

Life events—job changes, family needs, or retirement—are increasingly outweighing rate considerations as sellers reassess priorities in a market where rates in the low-to-mid 6% range appear more durable.

Pricing Strategy

Accurate pricing is critical. Overpricing increases the risk of extended days on market, which can stigmatize listings and lead to eventual price reductions. Buyers in 2026 are more patient and better informed, with more alternatives available than in recent years.

Sellers should rely on recent comparable sales and current local conditions rather than peak pandemic benchmarks. Homes priced correctly from the outset are more likely to sell efficiently and closer to asking price.

Concessions Are Becoming a Normal Tool

As affordability remains stretched for many buyers, seller concessions are playing a larger role in successful transactions. Closing cost credits, rate buydowns, and repair allowances are increasingly used to bridge gaps without cutting headline prices.

These tools allow sellers to remain competitive while helping buyers manage monthly payments and upfront costs. In many markets, concessions are not a sign of weakness but a practical response to current financing realities.

Preparation and Presentation Are Decisive

With inventory higher than in recent years, presentation matters again. Homes in excellent condition command stronger interest and pricing premiums, while properties needing repairs are more likely to linger. Minor improvements—fresh paint, deferred maintenance, professional cleaning, and quality photography—can materially affect outcomes.

Pre-listing inspections can also reduce surprises during escrow and improve buyer confidence. In a more balanced market, preparation often determines whether a home sells quickly or requires multiple price adjustments.

What This Means for Renters

For households choosing—or needing—to rent in 2026, the decision remains largely pragmatic. While rent growth has slowed in many markets, homeownership costs remain elevated due to prices and mortgage rates in the low-to-mid 6% range.

In much of the country, renting continues to offer lower monthly costs and greater flexibility, particularly for households without substantial savings or with uncertain time horizons.

The rent-versus-buy decision in 2026 depends heavily on location, finances, and length of stay. Modest home price appreciation suggests waiting may not result in lower purchase prices, but renting can still make sense for those prioritizing mobility or avoiding financial overextension.

Ownership builds equity and stabilizes long-term housing costs, while renting preserves optionality in a market still adjusting to higher rates.

For renters who aspire to buy, 2026 may be best viewed as a preparation period rather than a holding pattern. Strengthening credit, building savings, reducing debt, and monitoring target markets can materially improve future buying power.

For others, continuing to rent remains a rational choice, not a failure to “time the market.” In a market defined by normalization rather than disruption, aligning housing decisions with personal circumstances matters more than forcing a transition to ownership.

Conclusion: A Market in Transition

The 2026 housing market is defined less by dramatic change than by gradual normalization. Mortgage rates are expected to remain in the low-to-mid 6% range, sales activity may improve modestly, and home prices are projected to rise at a slower, more historically typical pace.

The volatility of the pandemic era has faded, replaced by a market driven more by income growth, supply constraints, and household needs.

For buyers, sellers, and renters, success in 2026 depends less on timing the market and more on adapting to it. Buyers gain more choice and negotiating room but face ongoing affordability challenges.

Sellers still benefit from limited supply, but pricing discipline and preparation matter more.

Renters continue to balance flexibility against long-term ownership goals. With rates unlikely to return to pandemic lows and prices expected to hold, the market rewards realistic expectations, financial readiness, and decisions grounded in personal circumstances rather than predictions of dramatic shifts.

As always, national housing reports can give you a “big picture” outlook, especially if you need to relocate, but much of real estate is local. And as local market experts, we know what’s likely to impact sales and drive home values in your particular neighborhood.

If you’d like to know how these projected trends affect you, we would love to help. Call or text Libby at (925) 628-2436. You can also contact us through email, info@guthriegrouphomes.com.

References

- Realtor.com

https://www.realtor.com/news/trends/housing-forecast-2026-mortgage-rates-affordability-improves/ - NAR Real Estate Forecast Summit

https://www.nar.realtor/events/nar-real-estate-forecast-summit - RealtorMag

https://www.realtor.com/news/trends/mortgage-rates-below-6-percent-august-2025/ - National Association of Realtors – First-Time Home Buyer Share Falls to Historic Low of 21%, Median Age Rises to 40.

https://www.nar.realtor/newsroom/first-time-home-buyer-share-falls-to-historic-low-of-21-median-age-rises-to-40 - Zillow

https://www.zillow.com/research/2026-housing-predictions-35800/ - MBA

https://www.mba.org/news-and-research/newsroom/news/2025/10/19/mba-forecast–total-single-family-mortgage-originations-to-increase-8-percent-to–2.2-trillion-in-2026 - FannieMae

https://www.fanniemae.com/media/56451/display - NAR

https://www.nar.realtor/sites/default/files/2025-11/ehs-10-2025-summary-2025-11-20.pdf

Leave a Reply