This past Wednesday was Veteran’s Day, and in honor of our veterans and active duty military personnel, we’d like to share a little information about homeownership and our service members.

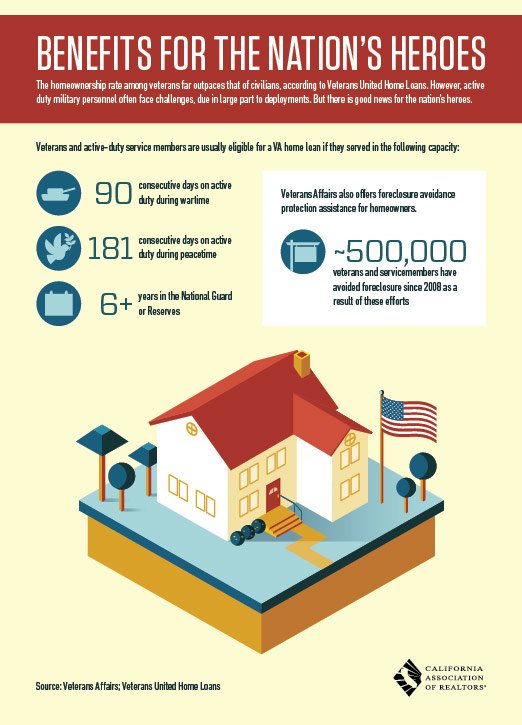

The homeownership rate among veterans far outpaces that of civilians, according to Veterans United Home Loans. However, active duty military personnel often face challenges, due in largest part to deployment. But there is good news for the nation’s heroes.

to download the high-resolution version

Veterans and active-duty service members are usually eligible for a VA home loan if they served in the following capacity:

- 90 consecutive days on active duty during wartime.

- 181 consecutive days on active duty during peacetime

- 6+ years in the Nation Guard or Reserves

Besides being eligible for VA loans, Vets and active-duty service members can get foreclosure avoidance protection assistance from the Department of Veterans Affairs. About a half a million veterans and service members have avoided foreclosure since 2008 due to this service.

Of course, not all Vets take advantage of VA loans or even try to purchase homes. While we are very grateful for the opportunity to receive this financial assistance, we know that there may be hundreds if not thousands of Veterans who don’t realize they qualify for these loans. If you know someone who has served, please point them to this article, or have them call us at 925-628-2436 so we can give them the proper information.

Besides being eligible for VA loans, Vets and active-duty service members can get foreclosure avoidance protection assistance from the Department of Veterans Affairs.

Our Veterans Need Other Types of Support Too

Sometimes a different sort of assistance is needed by our veterans, help that isn’t always available from the government. That’s why The Guthrie Group supports Fisher House, best known for a network of comfort homes where military and veterans’ families can stay at no cost while a loved one is receiving treatment, and Semper Fi Fund, providing immediate financial assistance and lifetime support to post-9/11 wounded, critically ill and injured members of all branches of the U.S. Armed Forces, and their families, ensuring that they have the resources they need during their recovery and transition back to their communities.

Recently Ken (a veteran himself) has joined the local chapter of the Marine Corps League, the only Congressionally chartered United States Marine Corps-related veterans organization in the United States.

Ken and the Marine Corps League will be helping local Marine reserve units this year with the collection and distribution of toys at Christmas for Toys for Tots.

If you’d like to know more about Fisher House, Semper Fi Fund or you’d like to donate toys or make a monetary donation to Toys for Tots, give Ken a call at 925-628-2436.

Leave a Reply