I’ve put together 15 First-Time Home Buyer Tips for you to get started on your journey toward the American Dream of homeownership. These tips are a great way to get started, but they do not cover everything you need to know about buying your first home. Still, this should give you a good head start. You can always ask questions about any particular tip or any other question you may have about purchasing a house.

#1. Start Saving for a Down Payment

When you first decide to get ready to buy a home, it’s an excellent idea to start saving for a down payment if you haven’t already done so. Having cash available for a down payment will give you more options when it comes time to make the purchase, as well as save you money on the interest you would otherwise pay on borrowed money.

So, how do you put together 20% down?

- Try having a percent of your paycheck automatically deposited in a savings account each month or whatever time period you get paid.

- Get a second job or work overtime. Depending on your personal situation, you might consider getting a part-time job nights and weekends.

- Lower your expenses. That can put extra bucks in the bank to purchase your dream home. Cut the cable, brew your own coffee at home, bring your lunch to work, etc. I’m sure you can find plenty of ways to cut back.

- Pay off credit card debt. I know this is actually spending money, but it will save you tons in the long run. Not only will getting those high-interest cards off your back save you the expense of interest you’re paying to the bank, but it will improve your credit score which will also save you money on your mortgage.

- Start a side business. There are plenty of opportunities to earn extra scratch on the side. Consider freelance work, sell products on Etsy, or share your skills with others on Udemy or Skillshare.

- Have a garage sale. OK, this option may not create a great deal of cash for your down payment, but, it should bring in some money as well as lighten your load when it comes to moving into your new home! 🏡

- Borrow. Yeah, this sounds counterintuitive at first blush. Why borrow from somewhere else to get money so you don’t have to borrow as much for your mortgage? Well, borrowing from your well-off relative may result in an interest-free loan. Maybe your mom will gift you a few thousand dollars. You may be able to borrow from your retirement plan. The point is, look past the obvious sticking points and explore your options.

- Get creative. Talk to friends, family, co-workers, etc. and see what they did to get their down payment together for their first home. You may just have a light bulb 💡 moment!

- Look into down payment assistance. We’ll go into that more in #3 below.

#2. Explore Your Mortgage Options

Mortgages. They can be seriously complicated, super simple, and 50 ways in between. In other words, there are a ton of different mortgage options and you’re going to need some guidance unless you have experience as a mortgage broker or banker. The trick is to consult a loan specialist before you start house shopping. Preferably get a referral, don’t pick someone out of the phone book.

Discover your options. Speak to a mortgage broker who may have more options for you to find the best loan for your needs.

Here are some questions to ask them.

- What is the right loan for me?

- What is a 30 Year Fixed vs 5-1 Arm?

- How much of a down payment will you really need?

- What happens if I put down more than I need? More than 20%? Is that a good thing to do?

- What will my monthly mortgage payment be?

- What is PMI and do I need it?

- What are “Taxes and Insurance”?

- What kind of fees will I have to pay when closing the loan?

Since every person or couple’s situation will be different, the best solution for you will be unique. The lingo can be confusing, the process slightly intimidating. Go in with an open mind, and willingness to learn. It will save your time, money, and grief later in the process.

#3. Research State and Local Home Buyers Assistance Programs

Number Three in our list of First-Time Home Buyer Tips is getting assistance from state, federal, and local programs. You’re going to have to do some homework here, but it can pay off big! I can’t give you all the information on down payment assistance, as your situation is unique, but I will give you a head start.

Federal Assistance

FHA or Federal Housing Administration offers assistance for certain borrowers. Requirements vary for both the borrower and the home being purchased.

The VA, or Veterans Affairs offer assistance to veterans and active servicemembers. Again, the requirements and qualification vary. You may want to read Everything You Need to Know about VA Home Loans before you speak to a loan agent.

Rural Housing Assistance. If you plan to live off the beaten path, you might want to look into housing assistance from the USDA, U.S. Department of Agriculture.

State and Local Assistance

HUD (Department of Housing and Urban Development) is a great reference for programs in California (as well as all other states of the union). They also have links to some programs at the city and county levels. Definitely, spend some time on this site, it could be well worth it.

#4. Determine How Much You Can Afford

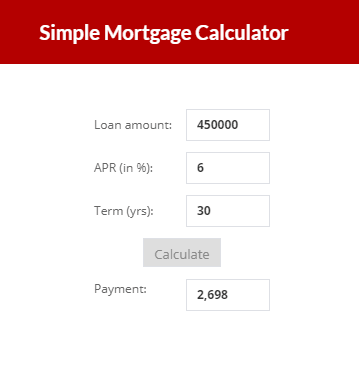

Use the simple mortgage calculator that’s in the sidebar of this post to get a basic idea of what you can afford. Enter the purchase price you think you can afford (less your down payment), then enter the interest rate you think you qualify for, and the number of years you want to pay off the loan in. Typically 15 or 30 years. You’ll have to make some educated guesses here, so take your results with a grain of salt.

Example:

You want to buy a house for $500,000. You have $50,000 for the downpayment. Enter 450000 as the Loan amount in the calculator.

You want to buy a house for $500,000. You have $50,000 for the downpayment. Enter 450000 as the Loan amount in the calculator.

You have average credit, so try using 6% as your interest rate. Enter 6 as the APR (in %).

You think you will need a 30-year loan, so enter 30 as the ‘Term (yrs)’.

In this example, your monthly mortgage payment would be about $2,698.

If that amount suits your budget, you’re ready for the next step. If not, try changing the loan amount either up or down until the payment seems doable to you.

I can’t stress enough that this is just a starting point! What you can actually afford may vary considerably from your estimate. The mortgage lender may require you to include insurance, property taxes, and/or private mortgage insurance (PMI) in the loan payment.

(You’ll need to pay property taxes and homeowners insurance no matter what. Plan to discuss this with your lender to see if these are required in your mortgage payment, can be paid separately by you, or sometimes it’s best to include taxes and insurance in your monthly payment as simple convenience.)

While doing your own basic affordability planning is a great start, the best approach is to speak to a mortgage lender or broker since there are so many variables that go into calculating what you can comfortably afford. It’s also the smart move as you will greatly benefit from their expertise for several other things on this list.

#5. Check Your Credit and Repair as Needed

Your credit is one of the most important aspects of borrowing a mortgage and therefore buying a house. A low credit score can make the difference between being able to qualify for a loan, or being able to afford the monthly payment if you do qualify. The better your credit, the easier it is to qualify, and you have the opportunity to get a better loan with the best rates.

Start by getting your free credit report from one of these sources. Annual Credit Report.com, the only free credit reports authorized by the Fed and available to you every 12 months. The process is a bit complex, as you actually go to each of the “Big Three” credit reporting agencies, fill out the forms, prove your identity, and get the credit report from each institution.

If that seems too daunting a task, consider either CreditKarma.com or NerdWallet.com. They are a bit easier to navigate and they offer free credit monitoring. They do however show you lots of ads and try an sell you various services. I suggest just sticking with the free info. It’s tempting to get a new credit card through one of the offers, but that could be the death of your home-ownership dreams. Alternately, if you have a Capital One or Discover account, they offer free credit scores and monitoring as well.

OK, now that you’ve gotten a copy of your credit report(s), it’s time to do a little detective work. Check out your score. Look for accounts that are not yours, belong to an ex, or someone with the same name. Also, look for mistakes; cards or student loans that you’ve paid off, etc. You’ll need to contact the credit bureau associated with your report and notify them of the discrepancy.

If everything looks good but your score is low, you’ll want to start paying down your credit cards, student loans, personal loans, or any other debt you currently carry. With one caveat. Do NOT close any accounts without speaking to your lender, a credit repair expert, or your Realtor. Contrary to what you might think, closing an account can spell disaster for your credit score.

#6. Compare Mortgage Rates

Hopefully, by now, you have spoken with a mortgage lender and you have a good idea what kind of mortgage you can qualify for, and what the rate might be. Nothing is set in stone until you are actually approved for a home loan. If your lender is a broker, they can shop for rates from a variety of lenders. If you’re dealing with a bank, they typically only have mortgages limited to the products the bank sells, which may or may not be the best rate or loan for you.

What do you think of our First-Time Home Buyer Tips so far? Good stuff, eh? Click here to Tweet!Click To TweetYou can also shop online for the best rate. But if you find one that sounds too good to be true, it probably is. Just looking online will usually show you the best rates for the shopper with the best credit score, 20% down, and a low debt to income ratio. My best advice, do your homework, get informed, find a mortgage broker you trust, and follow their advice. Additionally, there is more to it than what you see on the surface. Online calculators can only do so much. Only a human being can tell you what you truly qualify for, and what is the best mortgage and rate for your situation.

#7. Get a Pre-Approval Letter from Your Mortgage Lender

This is an important one. Get a pre-approval letter from your lender. Don’t confuse this with a pre-qualification letter. They don’t hold the same weight. Definitely read this article “Pre-Qualified vs Pre-Approved: What’s the Difference?” before you think about shopping for a house.

#8. Select the Right Real Estate Agent

Not all real estate agents are alike. Make sure you hire a licensed REALTOR®. Besides that, you may want to consider a few of these guidelines when finding the right agent for you.

- According to Forbes.com, “choose the person, not the experience”. Of course, you want to work with an agent or team with experience, but you’re going to be spending time with that person, so make sure you “mesh” with them.

- Talk with a recent client of the agent you’re thinking about working with. Ask questions; What was their experience like? Were they helpful? Did they communicate effectively? Would you hire them again? Your agent candidate should be able to put you in touch with several of their past clients for you to speak with.

- Check out their testimonials and reviews. Sites like Google, Facebook, Yelp, Zillow, and Trulia are a wealth spring of information about your prospective agent. Check the agent’s website as well for reviews and testimonials. Do your due diligence.

- Check the agent’s real estate license for any problems or disciplinary actions. Those will speak volumes. (The search on the DRE website is a little tricky. Be sure to ask the agent for their DRE License #, as well as their legal name under which the license is listed.)

- How much experience in the area you are looking to buy in does the agent have? 15 years of experience in a different county or state won’t help you much. Out of area agents will have to travel longer distances to show you homes, and they may not know the area very well. Make sure their area expertise lines up with your needs.

- Never hire a friend or neighbor. This is the fastest path to disaster when purchasing a home. This is the most important purchase of your lifetime, it’s best to keep this a business relationship, to begin with. An agent who knows you may be swayed by your emotion, rather than what’s really best for you. A good agent will help you make the hard decisions, ones that will do you right in the long run.

#9. Provide your Agent with Your “Must Have” List of Wants and Needs

This is one of the most important of the First-Time Home Buyer Tips. So, consider this; you start thinking about your dream home, and you can picture it in your mind. You know every little detail, but those details are all in your head. Your Realtor needs to know what you’re looking for. Create a list of wants and needs so your agent can keep their eye out for new properties that come on the market that fit your ideal. But to be realistic, you may not get everything you want in your first home. Be sure to separate deal breakers and “must haves” from things that would just be nice to have.

You may need to be flexible here. See the next Tip below.

#10. With the Help of your REALTOR®, Pick the Right House and Neighborhood for You

Your Realtor is your advocate. They are there to represent your best interests and help you find a house you love, but one that you can actually afford, and is right for you in the long run. As you may have heard or read, buying a home is a very emotional experience. Trust your agent to keep you moving in the right direction. With their knowledge of the real estate market, your wants and needs, and their knowledge of the city and neighborhoods, they can guide you to the “right house” for you and your circumstances.

#11. Stick to the Budget While Shopping for a House

So, you’ve been shopping for your new home with your agent, going to open houses, and tweaking your “must have” list. But so far all the homes you’ve seen are too expensive. You decide it would be a good idea to increase your budget. This is where emotion can get you into trouble. Please, stick to your original budget. It’s tempting to spend just a bit more to get what you “REALLY” want. But once you move into your new home, you’ll probably want to get some new furniture, maybe paint the kitchen, or some other upgrades and updates.

You’ll be much happier in the end if you leave some room in your budget to cover these expenses, rather than to spend everything on the house itself. There’s always going to be a house with more but costs more. Choosing a comfortable budget before shopping, and sticking to the budget will ensure that you can afford your new home, and still be able to maintain your lifestyle.

#12. Don’t Forget to Budget for Out of Pocket & Closing Costs

Speaking of budgets, you’ll want to include “out of pocket expenses” and “closing costs” in it. There are some expenses you may have to pay whether you purchase the home or not. And there are other expenses related to the final purchase of the property when you “close escrow”.

Out of Pocket Costs

In this video, I explain some of the out-of-pocket costs related to buying a house.

Closing Costs

There is a long list of possible closing costs associated with purchasing a home at the close of the transaction. These vary depending on circumstances, location, and other factors. You can find a list of some common closing costs here. As a general guideline, “buyers in California should expect to pay approximately 1-3% in closing costs on a purchase“. You’ll know in advance exactly what that amount is before close of escrow, so you’ll need to allow some wiggle room in your original budget.

#13. Let your Agent Do the Negotiations

This is where the rubber meets the road, and your Realtor earns their keep. (Of course, as a buyer, you don’t pay your agent. The seller does. But the relationship is still a fiduciary one. Meaning, they are there to protect your interest and needs.) Let your agent do the negotiating, this is what they do best. It’s your agents’ responsibility to represent you and get the best deal they can on your behalf. And they will do just that if you will let them.

#14. Don’t Skimp on Home Inspections

As you may recall from the video about out of pocket costs above, you’re almost certainly going to want at least one home inspection. You may also want or need a pest inspection, roof inspection, along with other specialty inspections. You will be responsible for paying for these inspections whether you end up buying the property or not. It’s very tempting to skimp on inspections due to the added expense and risk of spending money without a return. But the fact is, this is actually very cheap insurance that you aren’t buying a house that may need thousands of dollars in repairs.

If additional home inspections are recommended, please, get them done and save yourself a lot of pain, heartache, and expense later.

#15. Get the Right Insurance for Your Home, Including, (potentially Flood) and Earthquake Insurance

Typically you are required to purchase and maintain a homeowners insurance policy before close of escrow. No one likes to pay for insurance they don’t need, so it’s tempting to choose the cheapest policy you can get. But, make sure you get the right coverage for your needs and situation. Again, save yourself some headaches and heartaches if a future catastrophe were to happen, and get the insurance that makes sense.

If you live in a flood zone, you’ll be required to get flood insurance. But did you know that floods are the nation’s most common natural disaster? So even if your new house isn’t currently in a flood zone, you may want to consider flood insurance anyway. The average cost in California is only $67 a month, so discuss your options with your insurance agent.

You live in California. Think hard about earthquake insurance! Earthquakes happen every day. Even if you don’t live near a major fault, there are minor fault lines all across the state. Now, I’m not saying that California will tumble into the sea anytime soon, but it’s already been nearly 30 years since the Loma Prieta Earthquake that stopped the World Series in 1989.

If you were alive back then, you’ll remember the damage and the chaos that brought to the Bay Area.

If you just can’t afford flood and/or earthquake insurance right now, block out some time on your calendar each year to revisit your insurance situation. And upgrade your policy as needed and as you can afford it.

Conclusion

Thanks for reading and thanks for sharing!

You and I have just finished going over 15 First-Time Home Buyer Tips. I know it’s a lot to take in. And it’s also the reason you should choose a real estate agent early on in your home buying journey. An experienced agent can guide you through the maze of homeownership, put you in touch with lenders, inspectors, title companies, and just about any other service professional you may want to consult with along the way. Your Realtor has done this many times, so can provide you the knowledge and information you need to make this a smooth and happy process.

No matter who you choose to work with, Ken and I wish you the best of luck in purchasing your first home!

Leave a Reply